October 16, 2020, is a day worth remembering for most of the blockchain industry participants, because on the same day, OKEx, a well-known cryptocurrency exchange in the world, suddenly announced the suspension of withdrawals. When it came out, it immediately became the headline news of the major industry media that day, and even shocked the popular reports of traditional media.

And on the next day, various horror news and strange stories about OKEx and the so-called private key managers began to circulate in the circle, which can be said to confirm the witty saying of “the master is among the netizens”. But I have to say that OKEx, as an important representative of the industry, has indeed caused a lot of panic due to the suspension of withdrawals, and then some people began to sell the nicknamed “OKU” (USDT on the OKEx platform) at low prices in major channels.

On the same day, the author sent a comment on the incident with feelings, and focused on discouraging those partners who are offering OKU at a low price, and don’t panic. Now it turns out that those participants who sell at low prices may be annoyed. After all, OKEx officially announced the opening of the withdrawal function last night.

If OKEX said that OKEx’s suspension of withdrawal a month ago was a “Jing Ke’s dream”, now it can only be described as “wake up from dream”. However, many people who eat melon will be curious, even if OKEx reopens the withdrawal function, Because of the impact of the incident, can it still sit firmly in the position of the “three major”?

Don’t you know what a blessing?

When we look back at the beginning and end of the OKEx withdrawal event, we will find that the story is always so interesting. The reason is that, no matter when, panic is always easy to cause trampling, just like the Bitcoin market in 2018, those are When I sold the mining machine I bought for tens of thousands of yuan, I felt more desperate than frustration.

Maybe those who sold their OKUs at a low price would feel lucky at the time, because they have not lost all of them, and they have gotten back a lot, but what they don’t know is that many big off-market players have quietly received a lot of OKUs, I know At least a few of them have accepted OKUs with more than 7 digits.

Therefore, the real impact of this incident is actually those newcomers who have just participated in cryptocurrency trading. They may have never encountered such a problem, but for those old leeks, they have made a lot of money.

Although OKEX has been nicknamed “Happy Bean Platform” by everyone in the past, some “Happy Beans” may have increased in value after the panic passed. Some netizens even commented that OKEx is the only cryptocurrency exchange that can operate normally after being “checked on the water meter”.

For OKEx, it is also a story of “suffering from one’s power and losing the horse and knowing the wrong”. After all, since the birth of Bitcoin, there has been ups and downs and stumbling in the middle, and this time it has made OKEx a good practice of dealing with the crisis. The method is a good training for the entire team, and in a sense, it may become a “textbook case” for analysis.

How does OKEx return?

Of course, if the incident will not have any impact on OKEx, it must be an unthoughtful “open mouth”. For most users who have been restricted from withdrawing for a month, they will definitely be the first time the withdrawal is opened. Choosing to put forward their own assets is nothing wrong with it. After all, everyone is still surprised.

The author also believes that OKEx has anticipated this situation a long time ago, and they will definitely take a series of actions to deal with such problems, and the means of recovery will definitely use various welfare activities, perhaps for exchanges and users , A large wave of red envelope grabbing activities may already be on the way.

Of course, if OKEx launches welfare activities for users, other institutions will naturally not fall behind, and they will surely bring more welfare activities to users, so I can’t help but get excited.

OKEX However, after the cryptocurrency industry has experienced nearly 10 years of development, in fact, many early growth dividends have temporarily come to an end. After all, the overall situation has been determined. What is left to the market is that users will choose to see which exchange provides services and models that are more in line with their tastes, and this is the real point of competition.

Therefore, as OKEx, which is still a veteran exchange, you don’t need to worry too much. As long as you continue to “do not forget your original intention” to bring users a better experience, it will still stand on top of the industry.

However, for the entire industry, the OKEx incident may have a more far-reaching impact, and this is what we should be more concerned about.

Is the general trend of compliance coming?

There is such a news that deserves our attention during the month when OKEx has suspended withdrawals. On November 2, Ashley Alder, the chief executive of Hong Kong’s securities supervisory agency, said during his participation in the Fintech Week event that a licensing system for crypto assets will be introduced and all crypto trading platforms will be regulated, regardless of whether they trade security tokens.

This news is considered to be another turning point for cryptocurrency exchanges to start true compliance. It is very different from the previous SFC only supervising assets that meet the definition of securities or futures laws. This supervision is part of the global control of cryptocurrency exchanges. .

As the most important participant in the crypto asset contract market, Hong Kong is bound to be a battleground for military experts. OKEx, which started with contracts, happens to have an office in Hong Kong, which means OKEx may become the first batch of regulated trading platforms. , If the matter goes well, it will certainly bring more imagination to OKEx.

OKEX On the other hand, some people may question that OKEx’s investigation may be due to business related to cryptocurrency transactions, but as far as I know, this is not the case. The real reason is that something in the past years affected its private key control. Of course, there is a problem that the person in charge of the private key did not store the private key separately, but in fact, it is not only one executive who was investigated this time, but a few, to put it bluntly, a few private The key custodians were forced to investigate, which led to the suspension of coin withdrawals, instead of the various strange reasons and absurd stories of the editors.

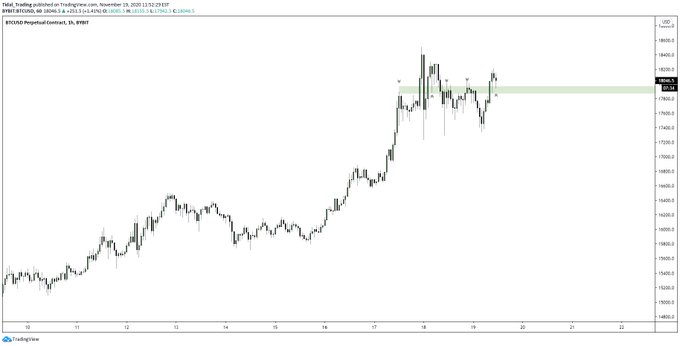

When we look back at the stories that happened in the past month, there is always a feeling that the cryptocurrency industry is going to end, but Bitcoin has gone straight to the sky like a stimulant, breaking through layers of obstacles, until it breaks the high of 18,000 US dollars. Just slow down, it can be said that one side is cold and the other side is spring.

It is worth mentioning that according to reliable sources, some private key managers of OKEx have finished assisting in the investigation and returned to their jobs, which is why there was an announcement last night. Of course, this also means that OKEx does not have so-called illegal activities, and those rumors are self-defeating.

When Bitcoin recently picked up again from its plunge in 2018, people no longer called it the “tulip bubble”. Instead, it became a sweet bun sought after by celebrities, funds and financial institutions. Similarly, after experiencing this suspension of withdrawal, OKEx will inevitably appear in the industry with a new attitude. This is the end of the story, as beautiful as a fairy tale.