Ethereum (Symbol: ETHUSD) snapped its five-day winning streak, falling sharply as on cues from a broader correction sentiment across the cryptocurrency market.

The second-largest crypto by market cap slipped by more than 12 percent from its Wednesday top of $481.20. So it appears, ETH/USD plunged as traders decided to secure their short-term profits from the pair’s 27 percent bull run that started on August 28.

It is because of the cryptocurrencies that too fell in tandem with Ethereum. The benchmark crypto Bitcoin, for instance, slipped by as much as 6.61 percent to an intraday low at $11,160. Other top tokens, including XRP, Chainlink, Bitcoin Cash, and Litecoin, too, plunged similarly.

Ethereum Overbought

Indicators pointed to an overbought sentiment. All these assets, including Ethereum, were trading well above their actual valuations, says the readings of their Relative Strength Indicator(s). ETH/USD’s daily RSI, for instance, was at 71, one point above the standard 70, before its downside correction began.

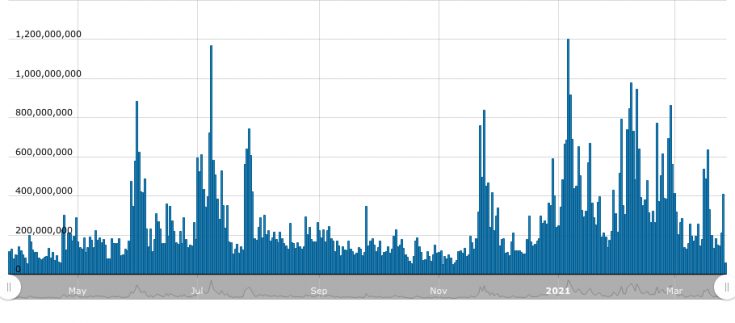

ETHUSD defends its bullish bias following a downside rejection at $420. Source: TradingView.com

Bulls, nevertheless, caught the falling price at $420. That is visible in the chart above: The daily candle is forming a long wick to the downside, illustrating that the ETH/USD dump was brief enough to alert buyers. As a result, the pair quickly rebounded back towards $450.

The same analogy led market analyst Cred to state that the ETH/USD’s downside correction on yesterday did not hurt its medium-term bullish bias.

“I’ve got $430s & $390s as HTF support,” he said. “[They are] the weekly consolidation that preceded the final leg up and monthly breakout. Directional bias is bullish as long as the overall structure is intact.”

US Dollar Rebounds

Another market analyst, Cole Garner, pitted the Ethereum price correction against a rebound in the US dollar index on Wednesday. He illustrated an inverse correlation.

The greenback started recovering from its two-year low on Tuesday, creating some headwinds for safe-haven assets, including Bitcoin and gold. While a rising dollar may have reduced the appeal of the benchmark cryptocurrency, it is its [own] positive correlation with Ethereum that may have triggered the latter down this Tuesday.

That is why Ethereum appeared to have been moving in the opposite direction of the US dollar index.

But, at the same time, the medium-term outlook for the US dollar remained bearish. It is because investors anticipated a long period of higher inflation, lower interest rates, and quantitative easing as global central banks attempt to aid economies through the COVID-19 pandemic.

That further pointed at a potential bullish continuation for both Bitcoin and Ethereum.

“Ethereum’s next levels are $550-600,” said one trader.

Let’s block ads! (Why?)