Issuing tokens may become the biggest bargaining chip in this war.

Original title: “The Way of DeFi | Ethereum Layer 2 will fight back. Who can stand out? 》

Author: Free and easy

Soldiers are also tricky, so they can show what they can’t, they show what they can’t, they show what they don’t use, they show far when they are close, and they show near when they are far-“Sun Tzu’s Art of War · Tactics”

The ancients put forward some tips for winning wars with great wisdom, and these tips are also applicable to today’s encrypted network wars.

Recently, the Ethereum network has been congested, and the fees charged by miners have also risen. Users are miserable. However, the Layer 2 solution, known as the hope of expansion, has failed to help solve the congestion problem. For a while, competing chains (such as BSC, Heco) are waiting for opportunities. They are all based on replication, supplemented by cheap handling fees to attract new users, and this simple and rude strategy has indeed played a very obvious role. Effect. And now, people are beginning to worry about whether the expansion methods of Ethereum can work, and worry about whether they are just some visible but intangible fog pieces.

The author tried to tell everyone through this article that this kind of worry is superfluous. Ethereum’s Layer 2 solution is beginning to exert its strength, and their success means that it will have an impact on the competitive chain.

What is the real Ethereum Layer 2?

Before entering the text, let us figure out a concept, what is Layer 2 of Ethereum?

In the current market, there are too many projects claiming to be Layer 2 of Ethereum, but in essence, they are in a competitive relationship with the Ethereum network. What is the real Ethereum Layer 2?

Simply put, they are an expanded network that migrates computing and data storage to the sub-chain, and transfers settlement to the Ethereum main network for processing. The former and the latter are in a symbiotic relationship.

The most promising Ethereum Layer 2 expansion solution is Rollup (mainly divided into Optimistic Rollup and ZK Rollup). Several Rollup projects frequently mentioned by Ethereum founder Vitalik Buterin, including ZKSync (Matter Labs), Loopring, Optimism , StarkWare (StarkNet) and Offchain Labs.

In theory, these solutions can expand TPS to thousands of levels under the current Ethereum mainnet, while trying not to sacrifice decentralization and security properties, and thus are hailed as the best expansion solutions. Note: Even if Ethereum 2.0 is successfully implemented, these Layer 2 networks have great significance.

Now, let’s learn about the upcoming Ethereum Layer 2 fried chicken one by one.

Option 1: ZKSync (Matter Labs)

ZKSync (Matter Labs) has attracted a lot of attention recently. One of the reasons is that it has just completed its Series A financing. The lead investor is United Square Ventures (USV). Matter Labs’ previous investors Placeholder, 1kx and Dragonfly continue to participate. In addition to this round of financing, the project party also announced a number of major ecological partners, including Aave, Balancer, 1inch, Curve, Binance, Coinbase Ventures, Huobi, Loopring, Argent, MYKEY, imToken, Flexa, MoonPay, ripio, CoinGecko. According to people familiar with the matter, the valuation of this round of financing ZKSync is 120 million U.S. dollars, and the financing is enough to burn Ethereum 2.0 online.

What ZKSync wants to challenge is the ultimate solution for Layer 2 expansion-ZK Rollup that supports general smart contracts. This is a very difficult task. The project team mentioned in its latest blog post:

“PLONK’s recursion and custom gate are the key elements that make almost complete compatibility possible. Our benchmark shows that the cost of the prover part is still insignificant compared to the gas part on the chain. We will release more technical details separately. Smart on zkSync The contract’s public testnet will be available in a few months.”

From the perspective of solutions, teams, and ecology, ZKSync (Matter Labs) can be regarded as a heavyweight player in the Ethereum Layer 2 track. We might as well try some simple interactions with the protocol (there may be airdrops) ), currently ZKSync supports a very single function, the only interactive operations are deposits, transfers, withdrawals, and Cruve interaction on the Rinkeby testnet.

Visit ” https://zksync.io/ “, and then connect to your own wallet to interact with ZKSync deposit, transfer and withdrawal operations. At present, deposits and withdrawals involve an Ethereum main network transaction, based on the current network 105 gwei Gas fee calculation, the cost of a deposit is about 14.7 US dollars, and the cost of a transfer is 0.0000871 ETH (about 0.13 US dollars).

To experience the zksync version of Cruve on the Rinkeby testnet, you need to switch to the Rinkeby testnet, and then visit https://zksync.curve.fi/ . Note that to test the application, you need to apply for some test coins, and other steps are related to the Ethereum mainnet. The Cruve makes no difference.

Option 2: Optimism

Optimism is another very noteworthy Ethereum Layer 2 seed project. It announced on February 24 that it had completed a US$25 million round of A round of financing. The investor is the well-known VC Andreessen Horowitz (a16z). Paradigm and IDEO raised USD 3.5 million in seed rounds.

Optimism may be the most closely watched Ethereum Layer 2 expansion project in the near future. The reason is that the Optimistic Rollup scheme it adopts is easier to support general-purpose smart contracts. In other words, some current popular DeFi projects can achieve Layer 2 faster. According to Vitalik et al., Optimism’s main network may be launched in March, and Synthetix will be able to complete the migration by then, and related transactions can greatly reduce processing costs.

According to official data, the Synthetix demo transaction fee can be optimized by 143 times, the transaction confirmation time is 0.3 seconds, and the Uniswap demo (Unipig) transaction fee can be optimized by 10-100 times, and the transaction confirmation time is about 0.169 seconds.

In general, Optimism, as an Ethereum expansion solution, inherits the security, composability and developer’s moat of the Ethereum main network, while improving performance, and does not impose any cost or trust requirements on Ethereum users. Substantial impact.

At present, a problem with Optimism is that withdrawing funds to the Ethereum mainnet will have a long challenge period (previously it was calculated on a weekly basis), which is not good for the user experience, but as market makers step in And to provide faster delisting services (simple and quick withdrawal program), this worry may become unnecessary.

Option 3: Loopring

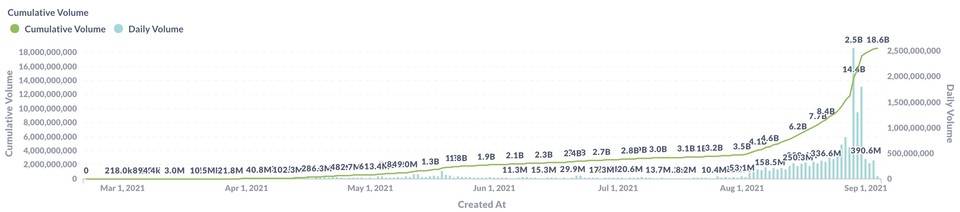

Loopring is the first Ethereum Layer 2 project to adopt the ZK Rollup expansion solution. Its current achievements are obvious to all. According to data from duneanalytics, the current value of assets locked in the Loopring Layer 2 network is close to US$210 million, more than half of which The assets of ETH are blue chip assets such as ETH, USDT, and WBTC.

Recently, the daily trading volume of Loopring DEX is approximately between US$8 million and US$30 million, of which AMM type transactions far exceed order book type transactions.

If the current user wants to use the Loopring product, the handling fee for recharging a fund is about 0.01575 ETH (approximately USD 24.4), while the transfer fee is fixed at 0.000096 ETH (approximately USD 0.144). In terms of handling fees, Loopring and The difference between zksync does not seem to be very big. If you want to experience the AMM type of Rollup two-layer network transaction in advance, Loopring is already a relatively feasible choice.

But if you are rushing to airdrop candy, then you may be disappointed, because Loopring has already issued tokens, and most of the tokens are already in circulation in the market.

So how did Loopring go from 0 to 1, attracting more than 200 million US dollars of funds into its Layer 2 network?

The answer is liquidity mining. Loopring officially provides LRC token subsidies for the main asset pair to attract users to transfer funds to the second-tier AMM pool. When the liquidity is sufficient, the project party does not need to provide incentives. .

Then we can imagine that those Rollup two-layer networks that have not yet issued tokens, if they also use this method to distribute their tokens, what will it be like?

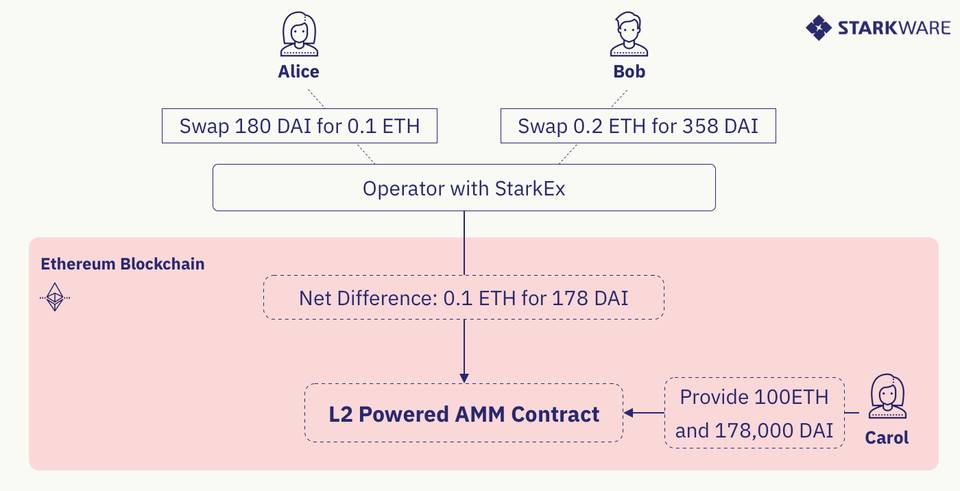

Option 4: StarkWare (StarkNet)

StarkWare is currently another Ethereum Layer 2 expansion project that cannot be ignored. It received 6 million US dollars in financing from Bitmain and other institutions and Vitalik Buterin at an early stage, and then received 30 million US dollars in financing led by Paradigm. Other well-known investors include Intel Capital, Coinbase Ventures, Multicoin Capital, etc. In February 2020, StarkWare received another US$40 million strategic round of investment. The investors are Intel Capital and Sequoia Capital.

In addition to the support of the well-known gold master’s father, the well-known derivatives agreement dYdX has announced the selection of StarkWare’s StarkEx as the second-tier expansion engine. It can be deployed as either the ZK-Rollup solution or the Validium expansion solution. The advantage of the latter is that it can be changed. Good scalability, but the compromise is to improve the trust assumption, so the security is not as good as the Rollup solution.

According to the StarkNet roadmap announced by StarkWare at the end of January this year, StarkWare’s second-tier expansion plan will be divided into 4 phases. At present, the basic construction of phase 0 has been completed. The subsequent phases 1 to 3 are codenamed planets, Constellation and universe, they correspond to single operation single application Rollup, single operation multiple application Rollup, and decentralized operation multiple application Rollup.

According to the plan, Phase 1 of StarkNet will be completed within a few months, and it is expected that Phase 2 and Phase 3 will be implemented before the end of the year.

summary

Beginning in March, a war on the expansion of Ethereum Layer 2 will officially kick off. At present, related seed projects have completed financing, and a number of well-known Ethereum ecological projects have been attracted.

The issuance of tokens has long become the biggest bargaining chip in this war. Loopring has demonstrated the attractiveness of liquidity mining on the second-tier network, such as ZKSync (Matter Labs), Optimism, StarkWare (StarkNet) and Offchain Labs. For projects that have not yet issued tokens, once the token issuance plan is officially announced, it will inevitably trigger an influx of users and funds. By then, the battlefield of Defi will be completed.

Source link: www.8btc.com

Let’s block ads! (Why?)