Visit us at https://is.gd/WdfFkh

Visit us at https://is.gd/WdfFkh

Visit us at https://is.gd/Ic522Q

Visit us at https://is.gd/cRZv7w

The cryptocurrency trading market is in a highly fragmented state, and it is difficult for traders to obtain global liquidity and price discovery.

Written by: Haohan, CEO of Apifiny

Compilation: Apifiny Asia Pacific Market

Currently, the cryptocurrency trading market is in its early stages, and in a decentralized market, regulation plays a key role.

“Fortune” magazine believes that Coinbase’s IPO plan is “a milestone in the crypto industry.” Like Netscape’s IPO plan, which marked the legitimacy of the Internet, Coinbase also sent a signal to the general public: In the eyes of the US Securities and Exchange Commission (SEC), cryptocurrency transactions are legal, compliant, and safe. Investors will have the opportunity to hold stocks on the largest crypto trading platform in the United States.

Many people view their investment in Coinbase as an investment in the future of the cryptocurrency trading industry. Coinbase is the largest cryptocurrency exchange in the United States by trading volume, and its trading volume is three times that of the second largest exchange in the United States, even leading the international level. However, the size of the cryptocurrency trading market is still far from that of the traditional trading market.

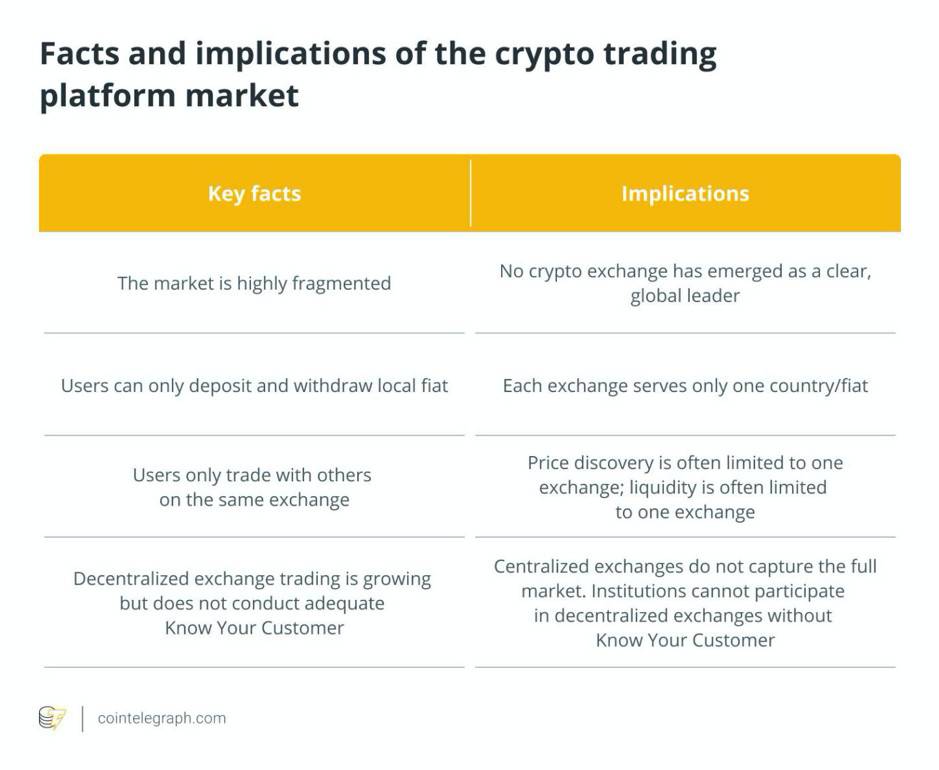

In order to better understand the nuances of the crypto trading platform market, we’d better observe the status quo of some industries first.

What is mentioned on the table are all important factors that affect the maturity of the market, and at the same time are the problems currently faced by cryptocurrency trading institutions. Currently, there is no single exchange that allows traders to obtain global liquidity, discover cross-border prices, and obtain the best prices in the world.

Today, the cryptocurrency trading market is still highly fragmented and there is no leader.

The trading volume of the world’s five largest cryptocurrency exchanges accounted for 41% of the global total. Among them, the trading volume of Coinbase, the largest exchange in the United States, accounts for only 2.1% of the global trading volume, ranking only 19th in the world. In the global market, there is no mature market leader that we expect.

According to the above data, the share of NYSE’s global stock trading volume is more than 12 times that of Coinbase’s global digital currency trading volume. The daily trading volume of the top two U.S. stock exchanges accounted for more than 50% of the global daily trading volume, while the trading volume of the top two U.S. crypto exchanges accounted for only 3% of the global trading volume.

Compared with traditional stocks, the cryptocurrency market is highly fragmented. The world’s two largest stock exchanges account for 51% of the global daily trading volume of stocks, while the world’s three largest cryptocurrency exchanges account for only 27% of the global daily trading volume of cryptocurrencies.

The cryptocurrency trading market is still in its infancy. In communicating with institutional traders and independent professional traders, we learned that institutions are still seeking platforms that meet institutional-level trading capabilities, and these requirements cannot be achieved on a single platform. E.g:

Each exchange is now its own trading “inland lake”, but there is no “canal” between them. In the US, traders can only trade with 2.1% of users worldwide, and their order books are completely different from other US trading markets (such as Coinbase and Kraken).

At present, only those users who can manage multiple exchange accounts in multiple countries and regions can achieve “global trading volume, liquidity and price discovery”, which is an arduous task that occupies both legal resources and technical resources.

Obviously, traders will benefit from a global order book based on a single currency, as well as the liquidity required to obtain the world’s best prices and execute large transactions. The industry urgently needs a “cryptocurrency version solution” equivalent to the National Best Trading Offer (NBBO) of traditional securities.

Binance and Coinbase are centralized exchanges that match orders from buyers and sellers, and execute transactions and settlements. The user’s cryptocurrency assets are kept by the exchange, and the user can only trade with other users on the same exchange. Even in terms of total amount, centralized exchanges cannot capture the total trading volume of the entire digital asset.

All this is because of the rise of decentralized exchanges, which realize peer-to-peer transactions. Decentralized exchanges usually realize the direct exchange of assets between traders without knowing customer information. In 2020, Uniswap’s trading volume once surpassed Coinbase, and all decentralized exchanges may be on par with centralized exchanges. Therefore, if you do not understand decentralized exchanges, you will not be able to fully understand the situation of the encrypted trading market.

Finding out how to incorporate the price discovery and liquidity of decentralized exchanges into centralized exchanges will have important advantages.

The trading volume of decentralized exchanges accounts for approximately 15% of the total cryptocurrency trading volume (based on CoinMarketCap data on February 16). The trading volume of decentralized exchanges has been growing rapidly. Uniswap’s trading volume has surpassed Coinbase even in 2020. Surprisingly, Uniswap achieved this feat with only 20 employees. Today, Venus’s trading volume is on par with Binance, and at the time of writing, Binance’s 24-hour trading volume is the market leader.

Professional traders may pay more attention to the security of “wallet-to-wallet” or “peer-to-peer” transactions in decentralized exchanges. But two problems still exist. First, without KYC on counterparties, institutional traders cannot trade on decentralized exchanges. Second, compared with centralized exchange transactions, the public chain technology supporting decentralized exchanges is slower and more expensive.

Institutional investors need decentralized exchanges that are faster, cheaper, and have sound KYC procedures. Therefore, decentralized exchanges must be built on faster and cheaper blockchains to attract institutional traders.

What is even more confusing is that today’s crypto exchanges are more like regional brokers than real, global exchanges. Take the example of trading Apple (AAPL) on E-Trade and Bitcoin (BTC) on Coinbase.

In the United States, professional traders who want to trade BTC can only participate in a small part of the global trading market through Coinbase. Price discovery and liquidity are only obtained through the BTC/USD order book on Coinbase. In other words, more than 97% of the world’s supply, demand, price discovery and liquidity can only be obtained through hundreds of exchanges.

In summary, compared to selling AAPL on E-Trade and selling BTC on Coinbase:

The status quo is that there is currently no real “global cryptocurrency trading market” in the world, but only hundreds of smaller local markets. If you compare the current status of the global cryptocurrency market to the traditional trading market, that is, AAPL is sold on more than 300 different exchanges, each with its own buyers and sellers.

There are two aspects to this problem. First, trading on a centralized exchange takes away many of the advantages of decentralized assets. Secondly, cryptocurrency transactions are fragmented into hundreds of scattered transaction “inland lakes”, each lake has its own local legal currency and cryptocurrency supply and demand relationship.

Centralized trading manages token listing permissions, custody, order matching and execution, and brokerage services. When users trade on a centralized exchange, users will give up a lot of control.

This centralized power brings hidden dangers to security and compliance, which has caused criticism from the market. In fact, traders in the Asia-Pacific region have initiated multiple refunds to show their resistance to CEX transactions. The younger generation is disgusted with centralization and dares to challenge it. The recent aerial warfare by American retail investors is a clear proof. And decentralization can ensure that no one entity can fully control the cryptocurrency.

Centralized exchanges are severely restricted in accessing the global market. Exchanges such as Coinbase and Gemini only accept users of fiat currency trading pairs (US dollars only) in a limited area (US only), while E-Trade opens access to many exchanges, stocks, and exchange-traded funds for its traders. Waiting for the door. In contrast, centralized exchanges closed the door to all other exchanges, severely restricting price discovery and liquidity, which resulted in higher spreads, lower fill rates, and higher slippage, namely Generally speaking, the market is inefficient. The concept of best buy and sell does not yet exist in the crypto world, because the BBO on Coinbase is not the same as the BBO on Gemini, Binance or Huobi.

From the perspective of professional traders, the current market does not yet have sufficient maturity and global trading capabilities. The segmentation of the cryptocurrency trading market is still in its infancy, and the needs of professional traders have not been met. The main reasons are as follows: (1) unable to enter the global market efficiently; (2) unable to obtain the best price in the global market, Nor can it obtain institutional-level liquidity.

In addition, due to the lack of KYC processes, it is not yet feasible for institutional traders to participate in decentralized exchange transactions. However, ordinary traders in Uniswap are very active. Uniswap’s users are completely on-chain transactions, open and transparent, and its 300,000 users have more transactions than Coinbase, which claims to have 35 million users. This shows that the entire giant whale market is traded outside of centralized exchanges, completely subverting the market’s understanding that Uniswap and decentralized exchange users are mainly retail investors.

No trading market can truly cover the world, retail and institutional traders cannot enter the truly global market, and there is no trading market that provides institutional-level DEX transactions.

The industry agrees that the continued digitalization of assets is inevitable. Bitcoin and Ethereum (ETH) are the native tokens of the blockchain. At present, the main transaction volume of the cryptocurrency trading market comes from these two mainstream currencies. However, the market value of cryptocurrencies is less than half of Apple’s.

Compared with the untapped digital asset market, the stock market is almost negligible. Although there is a great opportunity, it is still too early to predict the results.

Some leading exchanges around the world allow a large number of controversial token transactions, and many exchanges have insufficient anti-money laundering regulations. Although some exchanges claim to have licenses in some countries, it is difficult to imagine using a single country’s exchange license to provide global users with legal compliance in derivatives transactions. These compliance risks have brought severe challenges to the stability of some exchanges. Not long ago, after BitMEX was prosecuted, users lost and transaction volume declined, and the market structure of derivatives changed rapidly.

Institutional level transaction technology innovation has not yet become widespread. The current trading volume ranking only illustrates the current situation. The future story will be told by the trading markets. These trading markets provide real and global best buying and selling price discovery, and institutions’ understanding of DEX pricing and liquidity Access, and the ability to execute global trading strategies on a single platform.

Source link: cointelegraph.com

In the future market, investment needs more specialized calculations and research, and risks need to be disclosed more transparently and strictly managed. In this irreversible wave, professional institutions gradually stand at the center of the stage.

Written by: Ad

In 2020, in addition to Bitcoin once climbing to a high point, Ethereum 2.0 and distributed financial DeFi are also rapidly emerging, becoming the most cutting-edge new outlets in the blockchain industry. At the same time, global mainstream payment institutions such as VISA, MasterCard and Paypal have also accelerated their deployment in the field of blockchain and digital asset payment. The New Deal of the U.S. Banking Regulatory Department allows banks to provide customers with digital asset custody services. Catalyzed by this series of positive factors, the digital financial market ushered in a new stage of development.

Traditional financial institutions are running into the market. This is a market-specific consensus starting in 2020. The once rash development of the digital financial industry is gradually fading away from its green appearance. The crazy bull market for retail investors that occurred in 2017 is gone forever.

The frequency of the occurrence of “under the sand” and “chickens and dogs ascend to heaven” will gradually decrease; in the next market, investment requires more professional calculations and research, and risks need to be disclosed more transparently and strictly managed. In this irreversible wave, professional institutions gradually stand at the center of the stage.

In the second quarter report on the digital financial product lending market, Credmark counted 85% of lending company data. In the second quarter of 2020, the scale of existing loans in this field reached US$4.632 billion, an increase of 90.62% from the previous quarter; the value of collateral exceeded US$8 billion in the same period. , An increase of 87.34% month-on-month.

Institutional customers dominate the digital financial lending market. In the second quarter of 2020, the stock loan ratio between institutions and retail investors was 3.5:1; the value ratio of institutional and retail collateral in the same period was 2:1. From the difference in the ratio of the value of stock loans and collateral, it can be found that institutional customers do have a very obvious advantage in the pledge rate.

So, where is the development of professional service providers in the market now? Does the new wealth management product really meet the needs of the market? In the future development, how should these service providers strive to seize market opportunities? This issue of Chain News will take everyone to explore the development status of service organizations in the digital financial field.

So far, the current institutions providing digital financial services are mainly exchanges, wallets and professional financial service providers. The cost of launching financial services on the basis of supporting cryptocurrency transactions is relatively low. For wallets and financial service providers, the cost of supporting asset mainnets and user drainage has certain obstacles to their development of financial services, but this is also one of the opportunities for them to stand out from the track.

Binance <br>As the world’s leading exchange, Binance’s Binance Wealth Management provides one-stop integrated wealth management products and services. There are four categories of current products, fixed-term products, new currency mining, and asset management. Users can Perform asset management according to your own financial preferences.

Current wealth management is mainly Binance Deposit, which deposits digital assets on the Binance platform, deposit and withdrawal, similar to bank demand deposits. As the name implies, regular wealth management products are assets deposited or pledged for a fixed period of time. They are divided into four categories: Binance’s regular and irregular high-yield activities, lock-up staking, and DeFi mining. New currency mining refers to users participating in new currency mining projects by providing pledged digital assets. Asset management mainly refers to two categories: liquidity mining and dual currency investment.

OKEx

OKEx’s financial products mainly focus on the three major products of Yubibao, lending and earning coins. Yubibao mainly has four forms: current, regular, event and holding rebates. Users can receive currency-based wealth management income through simple deposits in Yubibao, deposit and withdraw as soon as the funds are transferred, and can transfer the currency in the account to Yubibao account to obtain income, or transfer Yubibao’s coins to other accounts . It combines a variety of wealth management services, including currency value-added products, lock-in mining, loan investment terminals, and third-party DeFi services to provide users with more interest-bearing options. At present, coin-earning products have supported nearly 30 encrypted digital currencies including lock-up mining and Yubibao.

<br> wheat wheat wallet purse (MathWallet) is a general-purpose encryption wallet assets, has been upgraded to MATH, MATH relying on the wallet, is a multi-link chain and across the core of the block chain assets Hub, is the first to support the Intelligent currency One of the crypto asset wallets of the chain (BSC). Maizi Wallet includes four major financial services: investment, wealth management, lending, and payment. At the same time, the MATH VPoS mining pool has been launched to mortgage digital assets. It can also automatically reinvest according to the daily interest rate to maximize returns.

Binyin Wallet <br>Blockinwallet was established in September 2019. It is a Singapore financial service platform under Binyin Mining Pool. Its customer base is mainly for miners and wallet users. It is currently applying for MAS compliance supervision. The Binyin mining pool was founded in November 2017 and was established by the original core team of BTC.com. It supports mining in all mainstream currencies. Its computing power for BTC, ZEC, LTC and other currencies often ranks first.

HyperPay

HyperPay is a digital asset wallet that integrates custodial wallets, self-managed wallets, co-managed wallets, hardware wallets and other services. It also has wealth management, currency transactions, legal currency transactions, lightning exchange, mortgage lending, market tracking, multi-signature co-management, and assets Hosting, merchant payment and other functions. HyperPay business is oriented to both B-side and C-side users. For ordinary currency holders, you can choose to manage financial wallets. For large asset customers and institutional users, you can choose self-managed wallets and co-managed wallets or customized hardware wallet solutions.

Matrixport

Matrixport is a one-stop digital asset financial service platform, which mainly provides digital asset trading, lending, custody and payment services for enterprises and individual users. Matrixport is a digital asset financial service platform established by Bitmain co-founder Wu Jihan. CEO Ge Yuesheng and founding team members are also from Bitmain. The company is headquartered in Singapore, with offices in Hong Kong, Switzerland and other places. Matrixport has launched digital currency transactions, digital currency custody, pledged loans and other products, and more innovative products will be launched one after another.

PayPal Finance <br>PayPal Finance is a comprehensive encrypted financial service provider. PayPal was established in August 2018. It mainly provides encrypted asset deposits and loans, asset management, brokerage, and brokerage for high-net-worth qualified individual investors and institutional investors. Comprehensive financial services such as derivatives trading. After PayPal Finance established its core customer base, it gradually launched customized new products based on customer needs, such as the official PayPal Private, which is similar to China Merchants Bank Golden Sunflower’s private customized services for high-net-worth customers.

RenrenBit

RenrenBit (RenrenBit) is a blockchain digital bank that focuses on C2C digital asset lending services. The platform provides information matching between borrowers and lenders, pledge custody and risk control. Its founder is Zhao Dong, an early practitioner of the currency circle, a shareholder of Bitfinex, and a major OTC trader.

From the perspective of market development, the current wealth management products that are highly accepted in the digital currency field and have a wider range of users are mostly single-currency gain-based products with stable returns and low risks. With the expansion of the financial attributes of digital currency derivatives, more institutions and investors have more abundant and differentiated requirements for the allocation and benefits of financial solutions.

Some investors are willing to pursue medium and high-yield diversified wealth management products on the basis of taking certain risks. More diversified investment categories such as dual currency wealth management, staking, lending, and strategic trading pioneered by Matrixport are gradually appearing in the market. Have a place on top.

Lianwen will start with Matrixport and analyze its layout of its financial products to explore how professional service providers can seize market opportunities in the digital finance era and expand their services to a wider range of financial institutions and high-net-worth individuals.

Digital financial professional service providers first helped miners to hedge their risks and protect the value of their assets. But in the more than ten years of vigorous development of cryptocurrency, participants have evolved from early cypherpunks to Bitcoin miners, and expanded to more and more mainstream investment institutions. Cryptocurrency has moved from a small circle to a larger world. These changes have accelerated the emergence of the professional field of digital financial services.

According to functions and needs, Matrixport’s products can be divided into loan and wealth management, asset custody, trading and one-click “CeDefi” products. Matrixport provides digital asset financial services for mining machines, mining pools, quantitative funds, digital currency lending platforms, digital currency funds, exchanges, OTC traders, etc., and has launched more than 50 products from product categories.

On the road to inclusive digital finance in the encrypted world, Matrixport equips the market with comprehensive products and services in a timely manner, and constantly updates according to the market to meet the financial needs of customers at different stages, helping customers to reduce risks, achieve wealth preservation, and increase value. .

From the perspective of Matrixport loan products, it is mainly divided into two types: basic loan and “zero interest loan”. The basic loan product supports the borrowing of USDC, USDT, BTC, BCH, ETH, LTC, and supports four pledge coins of BTC, BCH, ETH and LTC. The basic loan amount is between 1,000 USDT and 200,000 USDT, and large borrowing needs can be purchased through customized products. Matrixport’s zero-interest loan product integrates stop-profit and stop-loss products into digital currency loan products. The loan product mainly has three features: zero interest, no need to cover up and crash protection, which provides a strong guarantee for miners’ fund protection under extreme market conditions. Matrixport provides miners with a zero-interest loan solution, which not only better avoids risks, but also solves the pressure on the flow of funds of miners.

In addition, Matrixport also created the first dual currency wealth management product in the industry in October 2019. This novel product quickly became popular in the industry after it was launched. It gained the attention and use of users in more than 20 countries within a month of going online. , Binance also launched similar products.

Different from the traditional form of digital currency wealth management, dual currency wealth management products judge the settlement method based on the “pegged price” to ensure that one of the two digital assets will receive income. For example, BTC/USD(S) dual currency investment, the pegged price is “8000 USD”. When the BTC market price is lower than 8000 USD, the settlement will be priced in BTC, and the income will be more BTC; when the BTC market price is higher than 8000 USD, It will be settled in USDC and will earn more USDC. Provide customers with a tool to automatically buy bottom and cash out at the target price (pegged price). At present, dual currency wealth management provides several products including Bitcoin, Ethereum, and USD stable currency. The optional purchase period ranges from 1 day to 163 days, which can provide higher annualized income (30-200% annualized as common Income range).

As the first company in the industry to launch dual currency wealth management services, Matrixport’s dual currency wealth management products mainly include BTC, ETH and BCH three mainstream crypto assets. The optional purchase period of the products ranges from 1 day to 140 days. There are six major products. The highest annualized rate of return exceeds 900%.

Relatively speaking, Binance Dual Currency Wealth Management products were officially launched on August 20. They are mainly divided into three major product areas: BTC area, USDT area and BUSD area. However, its dual currency wealth management products are currently sold due to limit restrictions. Out of stock, the official annualized rate of return ranges from 6.00% to 160.00%.

Cactus Custody is a third-party institutional custody service provider launched by Matrixport and a Hong Kong trust company. Cactus custody originated from Bitmain’s internal custody system, and later developed into a fully functional third-party custody after Matrixport was separated from Bitmain.

Since most of the customers who need custodial services are 2B customers, security and business continuity are paramount to both customers and service providers. For security, Cactus Custody chose to manage private keys in the industry’s highest-level HSMs (hardware security modules) and a proprietary multi-layer heating and cooling storage system. The core custody infrastructure is deployed in the four-level data center of the bank vault on three continents. Eliminate single points of failure through system heterogeneity, dual-center settings and remote disaster recovery mechanisms to ensure the highest security and business continuity. Also through the design of responsibility isolation and zero trust system, it is guaranteed not to rely on any single person.

In terms of compliance, Cactus Custody not only holds a Hong Kong TCSP license, but also strictly abides by the “anti-money laundering” regulations in all operating jurisdictions, conducts KYC with the highest standards, and has suspicious transaction reporting procedures for on-chain and off-chain transactions. In addition, Cactus Custody also cooperates with Elliptic to integrate on-chain transaction monitoring, and monitors all on-chain transactions through Cactus Custody and Matrixport to meet regulatory requirements and protect customers from digital financial crimes.

Up to now, Cactus Custody can support 39 digital assets, and safeguard the security of more than 50 institutional customers and digital assets worth about 1 billion U.S. dollars, and provide customers with uninterrupted, highest-quality asset security and business continuity guarantees.

Bit.com is a professional derivatives exchange launched by Matrixport and specializes in options. Bit.com’s strategic positioning is to serve institutional and individual clients from all over the world, including miners/hedges, prime brokers, proprietary dealers and funds.

Bit.com’s self-built transaction engine with all intellectual property rights provides matching of 10,000 TPS per second, and introduces a portfolio margin mechanism to improve the efficiency of the institution’s capital use. At the same time, it adopts a more scientific and gentle gradual liquidation mechanism to provide maximum customer positions protection of. Thanks to its lending business and transaction engine, Matrixport can provide the lowest interest rates and transaction prices in the industry, allowing the cost of leveraged transaction customers to be significantly controlled.

In the six months since its launch, Bit.com has reached a level of about 200 million US dollars in daily trading volume. In addition, Bit.com also launched BCH options on February 1 to fill the gap in the BCH options market.

The DeFi fire in 2020 is a portrayal of the urgent needs of market participants for diversified financial products. However, due to the high learning costs and operational difficulties for ordinary users such as liquid mining, and the large amount of funds entering the market The interaction cost of the Ethereum network has risen sharply, and the DeFi boom is still far from achieving true “inclusiveness” from the level of the number of users.

In response to this situation, Matrixport has launched a simplified one-click “CeDefi” product in response to market demand, taking into account the convenience of Cefi and the flexibility and transparency of Defi, and has launched a series of products that are well received by the market, such as current machine gun pool and smart selection And other products, it can help customers automatically switch between different DeFi high-yield projects, compound interest investments, current or large T+1 redemptions, and combined with mortgage lending, that is, mortgage BTC/BCH/ETH and other currencies to lend USDC/USDT for liquidity Functional mining and other functions enable BTC/BCH/ETH holders to directly invest in DeFi income, which greatly facilitates customers and enriches the scene.

At the same time, Matrixport also provides users with a combination of DeFi and derivatives investment product “Trend Zhiying” to help customers obtain excess returns in unilaterally rising or falling markets.

Digital financial professional service institutions can provide a complete system and relatively personalized services, which can adapt to different customer needs, and are also convenient for supervision by regulatory authorities, so as to achieve compliance and legal operations and reduce systemic risks. In the long-term development and precipitation of traditional financial models, countless operating models and new gameplay have evolved, and these traditional financial derivatives have gradually infiltrated the digital financial field of encrypted currencies.

Matrixport first launched its product in October 2019, and it has been online for 1 year and 4 months. In the past year or so, Matrixport has accumulated trust and reputation in the industry based on its rich financial product matrix and product innovation speed, rigorous and prudent risk control management, and professional compliance operations. Criticize quite loyal “fans.”

Matrixport CEO Ge Yuesheng told Lianwen, “Matrixport’s AUM (asset management scale) has exceeded 1 billion U.S. dollars in just over a year, and its loan balance exceeds 200 million U.S. dollars. The current wealth management scale exceeds 300 million dollars.”

With the expansion of services to a wider range of financial institutions and high-net-worth individuals, Ge Yuesheng hopes that Matrixport’s vision to become a “digital currency bank” is gradually being implemented. In 2021, Matrixport will shift its focus from building a product matrix and service system to market and customer service. Investment in this area will continue to increase, and the service area will also expand to more regions in Asia Pacific and Europe.

As Ge Yuesheng said, “In this era of digital financial services, Matrixport hopes to continue to lead the digital currency industry in innovative financial services and bring more professional and secure services and products to the industry.”

“2020 is not only the first year of digital currency financial services, but also the first year of mining financial services. A large number of structured products and lending products have experienced explosive growth and applications in 2020.” Ge Yuesheng was talking about 2020 The changes in digital financial services in the year are expressed.

Digital finance is accelerating, and the industry has ushered in structural changes. How to comprehensively deploy and provide precise services is the focus of development. A complete and leading product line, combined with professional and efficient security services, will enable the project to have a better market reputation and customer reviews. Based on the deep cultivation of the industry and the understanding of the market, Ge Yuesheng believes that 2021 will be a surging bull market, and preparing for a large number of customers and institutional funds will become the focus of Matrixport in 2021.

In Ge Yuesheng’s view, the reason why Matrixport has been able to develop into an industry-leading professional financial services organization so quickly is that, compared with its peers, it must always emphasize “full service” based on its rich industry resources and leading technical capabilities. “And “Professional Products”. Services and products increase user stickiness, and the synergy between businesses can also make a single product more competitive.

Professional Investor (Lyn Alden) Explains Ethereum Investment in 2021 🔥

Hit Like, Share, and Subscribe for more daily cryptocurrency news!

Read Lyn’s Full Analysis: https://www.lynalden.com/ethereum-analysis/

Raoul Pal Explains How 1 Ethereum Could Reach OVER $20,000 Per Coin: https://youtu.be/FSnxg5q-ahg

Tyler Winklevoss Explains How 1 Ethereum Could Reach OVER $75,000 PER COIN: https://youtu.be/JZDMDnWkhLA

Altcoin Daily, the best cryptocurrency news media online!

Follow us on Twitter:

Timestamp:

0:00 – Introduction (Watch Whole Video!)

1:38 – Who is Lyn Alden?

3:46 – An Economic Analysis of Ethereum (Prediction)

7:16 – Worst Case Scenario (Prediction)

8:45 – Lyn’s Final Thoughts (Prediction)

12:48 – Major Takeaways

**Note: My overall opinion is that the name of the game is to accumulate as much Bitcoin as possible. Alts are interesting but a lot more speculative. I use them to accumulate more Bitcoin.

***********************************************************************

🏺Support The Channel!!🏺(We Get A Kickback From These Affiliate Links)

Support us on Patreon here 👇 and be a part of exclusive content and voting power

https://www.patreon.com/AltcoinDaily

Protect and store your crypto with a Ledger Nano:

https://www.ledger.com?r=4b0f6c5711dc

Get $10 Sign-Up & Buy Bitcoin With Swan👇

https://www.swanbitcoin.com/aarontarnold/

Buy Bitcoin with Cash App:

Try it using my code and we’ll each get $5. MMQHWLG

https://cash.app/app/MMQHWLG

Sign up for Coinbase & get $10 in free Bitcoin:

https://www.coinbase.com/join/arnold_a2r

To open an IRA with iTrustCapital & get 1 month FREE use code "ALTCOIN" or click this link:

https://bit.ly/3oNgEU6

Earn Bitcoin For everyday online purchases:

https://lolli.com/ref/3fFthESfAq

Fold App: Get 20,000 sats by using my referral code: “RNAKA4MF”

https://use.foldapp.com/r/RNAKA4MF

🏺Buy Me A Beer 🏺

►BTC: 3DYCrB2RCrREM6y3Ahxxuv9JjSVd6yrbz4

►BTC: 3DYCrB2RCrREM6y3Ahxxuv9JjSVd6yrbz4

***********************************************************************

Altcoin Daily, the best cryptocurrency news media online!

#bitcoin #cryptocurrency #news #btc #ethereum #eth #cryptocurrency #litecoin #altcoin #altcoins #forex #money #best #trading #bitcoinmining #invest #trader #cryptocurrencies #top #investing #entrepreneur #business #success #investment #finance #motivation #coinbase #stocks #wallstreet #investor #wealth #bullish #bearish #cryptolive #altcoindaily

***NOT FINANCIAL, LEGAL, OR TAX ADVICE! JUST OPINION! I AM NOT AN EXPERT! I DO NOT GUARANTEE A PARTICULAR OUTCOME I HAVE NO INSIDE KNOWLEDGE! YOU NEED TO DO YOUR OWN RESEARCH AND MAKE YOUR OWN DECISIONS! THIS IS JUST EDUCATION & ENTERTAINMENT! USE ALTCOIN DAILY AS A STARTING OFF POINT!

This is NOT an offer to buy or sell securities.

Investing and trading in cryptocurrencies is very risky, as anything can happen at any time.

This information is what was found publicly on the internet. This information could’ve been doctored or misrepresented by the internet. All information is meant for public awareness and is public domain. This information is not intended to slander harm or defame any of the actors involved but to show what was said through their social media accounts. Please take this information and do your own research.

Most of my crypto portfolio is Bitcoin, then Ethereum, but I hold many cryptocurrencies, possibly ones discussed in this video.

cryptocurrency, crypto, altcoin, altcoin daily, news, best investment, top altcoins, ripple, ethereum, xrp, crash, bull run, bottom, crash, rally, macro, price, prediction, podcast, interview, trump, finance, stock, investment, too late, when, bitcoin good investment, how do i buy bitcoin, buying bitcoin united states, bitcoin, cryptocurrency news, bitcoin news, cryptocurrency news media online, defi, 2021, end of year,

ethereum investing strategy, should i buy ethereum?, ethereum a good investment?,

#bitcoin #cryptocurrencynews #bitcoinnews #cryptocurrencynewsmediaonline #ethereum

NASSAU, Bahamas, Dec. 30, 2020 /PRNewswire/ — Doo Prime, an international pre-eminent online broker successfully secured a one-year professional indemnity (PI) insurance for Doo Prime Bahamas Limited, effectively from December 10, 2020.

This PI insurance is an acknowledgement of Doo Prime as a licensed professional, and their dedication in complying with the higher standards of practice in the online trading industry.

Through this PI insurance, the aggregate limit of liability shall be US $500,000.00, being the insurer’s maximum liability exposure to all claims during the PI insurance policy period.

The insurance, often referred to as professional liability insurance or PI insurance, will cover any legal costs and expenses incurred by Doo Prime and any loss or damages incurred as a result of Doo Prime’s liability towards customers.

Moreover, the framework of PI insurance originates from internationally applicable standards of practice, knowledge, and ethics.

Besides, PI insurance shall be governed by and construed in all respects following the laws of Puerto Rico, and the parties agree to submit to the non-exclusive jurisdiction of the courts of Puerto Rico.

Doo Prime prides itself as a global leading online broker, strongly adhering to values in ensuring utmost security and safety for all our clients.

About Doo Prime

Doo Prime is under the Doo Group with operation centers in Hong Kong, Dallas, Singapore, Kuala Lumpur, and other regions. Our main ethos is to provide professional investors with global financial instruments (CFDs) on our trading platform.

Doo Prime holds the financial regulatory licenses in Mauritius and Vanuatu, which has granted the opportunity to deliver the finest trading experience to more than 18,000 professional clients, alongside with managing a massive trading volume of billions of dollars monthly.

By the virtue of robust technological innovation by the group, Doo Prime has achieved seamless connection with the global trading market, providing thousands of CFD products on multiple trading terminals such as MT4, MT5, TradingView, InTrade, and more, covering Forex, Precious Metal, Energy, Indices, Securities and Futures, allowing clients to invest globally with one click.

With a solid vigorous group background, competitive trading cost, convenient deposit and withdrawal methods, plus 24/7 multilingual customer service, Doo Prime is committed to become private veteran broker.

Website: www.dooprime.com

SOURCE Doo Prime

NASSAU, Bahamas, Dec. 30, 2020 /PRNewswire/ — Doo Prime, an international pre-eminent online broker successfully secured a one-year professional indemnity (PI) insurance for Doo Prime Bahamas Limited, effectively from December 10, 2020.

This PI insurance is an acknowledgement of Doo Prime as a licensed professional, and their dedication in complying with the higher standards of practice in the online trading industry.

Through this PI insurance, the aggregate limit of liability shall be US $500,000.00, being the insurer’s maximum liability exposure to all claims during the PI insurance policy period.

The insurance, often referred to as professional liability insurance or PI insurance, will cover any legal costs and expenses incurred by Doo Prime and any loss or damages incurred as a result of Doo Prime’s liability towards customers.

Moreover, the framework of PI insurance originates from internationally applicable standards of practice, knowledge, and ethics.

Besides, PI insurance shall be governed by and construed in all respects following the laws of Puerto Rico, and the parties agree to submit to the non-exclusive jurisdiction of the courts of Puerto Rico.

Doo Prime prides itself as a global leading online broker, strongly adhering to values in ensuring utmost security and safety for all our clients.

About Doo Prime

Doo Prime is under the Doo Group with operation centers in Hong Kong, Dallas, Singapore, Kuala Lumpur, and other regions. Our main ethos is to provide professional investors with global financial instruments (CFDs) on our trading platform.

Doo Prime holds the financial regulatory licenses in Mauritius and Vanuatu, which has granted the opportunity to deliver the finest trading experience to more than 18,000 professional clients, alongside with managing a massive trading volume of billions of dollars monthly.

By the virtue of robust technological innovation by the group, Doo Prime has achieved seamless connection with the global trading market, providing thousands of CFD products on multiple trading terminals such as MT4, MT5, TradingView, InTrade, and more, covering Forex, Precious Metal, Energy, Indices, Securities and Futures, allowing clients to invest globally with one click.

With a solid vigorous group background, competitive trading cost, convenient deposit and withdrawal methods, plus 24/7 multilingual customer service, Doo Prime is committed to become private veteran broker.

Website: www.dooprime.com

SOURCE Doo Prime

Danny Masters, chief strategy officer of CoinShares and a former commodity trader at JPMorgan Chase, told CNBC that the financial landscape has changed, and for portfolio managers, not investing in Bitcoin may be more risky than investing in Bitcoin.

The head of this digital asset management company mentioned on the CNBC program “Power Lunch” that in the past, it was considered risky for asset managers working in institutions to invest in Bitcoin. But he claimed, “As a portfolio manager, holding Bitcoin in his institutional investment portfolio is rapidly transforming into professional risks without Bitcoin in the portfolio. This is a very surprising change.”

CNBC host Kelly Evans summarized his statement:

“For portfolio managers, if they hold some bitcoin, they will not be fired, but if they don’t have bitcoin, they may be fired.”

Masters believes that Bitcoin is considered a highly volatile asset, because “it turns out that other asset classes are far more volatile than people expected.”

Masters stated that Bitcoin has got rid of its previous negative image among mainstream investors. The question now is no longer whether companies will adopt this digital asset, but when and how much. He mentioned Square, Microstrategy and Paypal. Investment in Bitcoin.

These companies “are outperforming the market because they are buying Bitcoin publicly,” and the result is:

“No doubt caused a sensation.”

Masters stated in October that although the founder of the major derivatives exchange BitMEX was accused of causing the price of Bitcoin to fall, the rebound trend of Bitcoin is getting stronger and stronger. As its price is not affected, Bitcoin is in a very favorable position. Status.

“In the case of the bankruptcy of the MtGox exchange, the hacking of Bitfinex, Trump’s criticism of cryptocurrencies, and many other events that caused market volatility, Bitcoin has performed outstandingly. I am shocked that Bitcoin prices rarely fall, especially in During BitMEX’s charges.”

The Fear and Greed Index currently reads 92 (total reading is 100), indicating that the market is in a state of extreme greed. Since the index hit 95 points in June 2019, there has never been such a level.

Most investors who follow Bitcoin have recently heard of the increasing influence of Bitcoin futures and options markets on Bitcoin prices. The same goes for the price fluctuations caused by OKEx and Huobi exchange’s liquidation.

Considering that the derivatives market now plays a greater role in Bitcoin price fluctuations, it is becoming more and more necessary to evaluate some key indicators used by professional traders to measure market activity.

Although evaluating futures and options contracts can be quite complicated, the average retail investor can still benefit from knowing how to correctly interpret futures premiums, funding rates, option skew, and put/call ratios.

Futures premium

The futures premium measures the price of long-term futures contracts relative to the current spot prices in the traditional market. It can be seen as a relative reflection of investor optimism, and the trading price of futures is often slightly higher than that of spot exchanges.

In a healthy market, the premium for two-month futures should be between 0.8% and 2.3%. Any number above this range is extremely optimistic. At the same time, the absence of a premium on futures indicates that investors are bearish.

The past week has been like a roller coaster, the futures premium index reached 2% on November 24, and the price of Bitcoin also reached a peak of $19,434.

Although the current premium is 1.1%, but more importantly, despite a 14% drop, this indicator remains above 0.8%. Generally speaking, investors consider this level to be bullish. Yesterday we could see the Bitcoin price hit a new high of over $19,900.

Perpetual Futures Contract Funding Rate

Funding fees for perpetual futures contracts are usually charged every eight hours. The funding rate ensures that there is no risk of transaction imbalance. Even if the positions of the buyer and the seller are always the same, the leverage may be different.

When the buyer (long) uses more leverage, the funding rate will be positive. Therefore, these buyers will pay higher fees. This issue is especially important during bull market periods, because bull market periods usually require stronger bulls.

A funding rate of over 2% per week means extreme optimism. This level is acceptable during market upswings, but if Bitcoin prices are in a sideways or downtrend, this level is problematic.

In this case, the buyer’s high leverage will bring a lot of liquidation possibilities during unexpected price drops.

Please note that despite the recent bull market, the weekly funding rate remains below 2%. This data shows that although traders are optimistic, buyers are not over-leveraged. Similarly, during the $1,400 drop on November 26, this indicator remained at a healthy and neutral level.

Option skew

Unlike futures contracts, options are divided into two parts. The buy option allows the buyer to buy bitcoin at a fixed price on the expiry date. On the other hand, the seller of options will be obliged to sell Bitcoin.

The 25% delta skew of options compares equivalent call (buy) and put (sell) options. If the cost of using call options to prevent price increases is higher, the skew indicator will become a negative range. When investors are short, the situation is just the opposite, leading to premium trading of put options, leading to a positive shift in the skew indicator.

Oscillations between -15% (slightly bullish) and +15% (slightly bearish) are typical and expected. It is very unusual for most markets to remain flat or close to zero most of the time.

Therefore, traders should monitor more extreme situations because they may indicate that the market maker is unwilling to take the risk of either party.

The above chart shows that since November 5th, option traders are reluctant to establish short positions. Therefore, traders will consider this to be a very bullish situation.

Put/call option ratio

By measuring whether more transactions are carried out by buying options or selling options, the sentiment of the entire market can be judged. Generally speaking, call options are used for call strategies, and put options are used for put strategies.

The ratio of put options to call options is 0.70, indicating that the open position of put options is 30% less than the call options, so it is called.

In contrast, the ratio of put options to call options is 1.2, indicating that there are 20% more open put options than call options, which can be considered a put. One thing to note is that this indicator integrates the entire Bitcoin options market.

In the current situation in the market, investors will naturally seek downside protection because Bitcoin exceeds $19,000, even though the put/call ratio is much lower than its six-month average of 0.90. The current 0.64 level shows that professional traders are not pessimistic.

Overall, these four key indicators have remained stable, especially considering that the market has just suffered a traumatic correction and the price of Bitcoin has fallen to $16,200.

With the price of Bitcoin once again breaking through $19,500, almost all investors are wondering whether Bitcoin has enough power to break its all-time high this week.

From the perspective of derivatives trading, nothing can stop it.