TORONTO, March 12, 2021 (GLOBE NEWSWIRE) — Bitfarms Ltd. (“Bitfarms” or the “Company”) (TSXV: BITF / OTC: BFARF), one of the largest, oldest and most cost-effective publicly traded bitcoin mining operations in the world, today announces it has retained CORE IR, a leading investor relations, public relations and strategic advisory firm, to assist the Company with investor relations, public relations and shareholder communications services.

CORE IR will focus on expanding market awareness for Bitfarms and conveying the Company’s business model and growth strategies to the institutional and retail investment communities. CORE IR, a boutique investor and public relations strategic advisory firm based in New York and other U.S. financial districts, specializes in leveraging the most effective investment, growth, and exposure strategies for small to mid-sized companies through an integrated approach to relationship development and corporate communications.

“Recognizing CORE IR’s high level capital markets experience and investor network reach in the U.S., we believe CORE IR is a perfect fit for our company at this exciting time of shareholder value creation and growth potential,” said Bitfarms CEO Emiliano Grodzki.

“CORE IR is a great fit for Bitfarms and we are very pleased to have the opportunity to work with management in executing our comprehensive approach to help the Company expand its outreach and engagement strategies. We look forward assisting the Company in achieving its corporate goals,” added CORE IR President and Co-Founder Scott Gordon.

CORE IR has been engaged at a rate of US$15,000 per month for an initial term of twelve months and thereafter may be extended by mutual agreement or terminated earlier by a party with 30 days written notice after 6 months of service. CORE IR has also agreed to a one-time grant of 15,000 incentive stock options (the “Options”) exercisable at a price of C$6.35 per share for a period of two years. The Options will be subject to the terms of the Company’s stock option plan and will vest as to 25% on each three-month anniversary of the Effective Date. The options due and issuable pursuant to this agreement are subject to the approval of the TSX Venture Exchange. Other than the options, neither CORE IR nor any of its directors, officers or employees have any interest, directly or indirectly, in Bitfarms or its securities, or any right or intent to acquire such an interest.

Issuance of Shares

The Company further announces it has issued 6,221 common shares at a price of $0.69 per common share to a certain shareholder as a result of an issuance deficiency noted in connection with the 2018 merger between Blockchain Mining Ltd. (a predecessor to the Company) and Backbone Hosting Solutions Inc. (the Company’s operating subsidiary).

About Bitfarms Ltd.

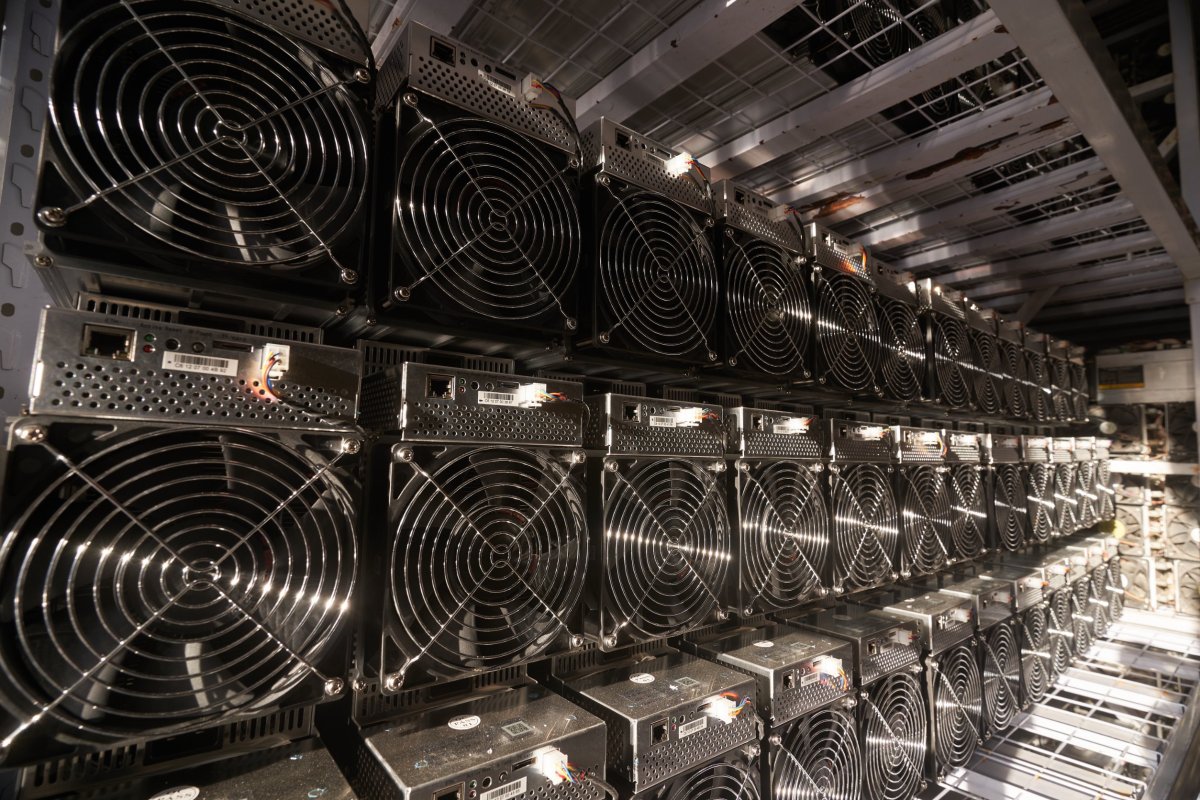

Founded in 2017 Bitfarms is one of the one of the largest, oldest, and most cost-effective public bitcoin mining operations in the world. Bitfarms run vertically integrated mining operations with onsite technical repair, data analytics and engineers to deliver high performance and uptime of operations.

Having demonstrated rapid growth and stellar operations, Bitfarms became the first Bitcoin mining company to complete its long form prospectus with the Ontario Securities Commission and started trading on the TSX-V in July 2019. Bitfarms is currently listed as a Rising Star by the TSX-V.

Bitfarms has a diversified production platform with five industrial scale facilities located in Quebec. Each facility is 100% powered with environmentally friendly hydro power and secured with long-term power contracts. Bitfarms is currently the only publicly traded pure-play mining company audited by a Big Four audit firm.

To learn more about Bitfarms’ events, developments and online communities:

Website: www.bitfarms.com

https://www.facebook.com/bitfarms/

https://twitter.com/Bitfarms_io

https://www.instagram.com/bitfarms/

https://www.linkedin.com/company/bitfarms/

About CORE IR

Headquartered in Garden City, New York, CORE IR is comprised of senior market leaders with expertise in institutional and retail investor relations, integrated corporate communications, and capital markets advisory services. CORE IR provides proprietary integrated investor and public relations solutions that yield targeted exposure for small to mid-sized companies. For more information, please visit www.coreir.com.

Cautionary Statement

Trading in the securities of the Company should be considered highly speculative. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain “forward-looking information” within the meaning of applicable Canadian securities laws that are based on expectations, estimates and projections as at the date of this news release. The information in this release about future plans and objectives of the Company, are forward-looking information. Other forward-looking information includes but is not limited to information concerning: the delivery of new miners on schedule and otherwise in accordance with the contract terms; the intentions, plans and future actions of the Company, as well as Bitfarms’ ability to successfully mine digital currency, revenue increasing as currently anticipated, the ability to profitably liquidate current and future digital currency inventory, volatility of network difficulty and digital currency prices and the resulting significant negative impact on the Company’s operations, the construction and operation of expanded blockchain infrastructure as currently planned, and the regulatory environment of cryptocurrency in the Provinces of Canada.

Any statements that involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information.

This forward-looking information is based on reasonable assumptions and estimates of management of the Company at the time it was made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to: the global economic climate; dilution; the Company’s limited operating history; future capital needs and uncertainty of additional financing; the competitive nature of the industry; currency exchange risks; the need for the Company to manage its planned growth and expansion; the effects of product development and need for continued technology change; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; network security risks; the ability of the Company to maintain properly working systems; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; and volatile securities markets impacting security pricing unrelated to operating performance. In addition, particular factors which could impact future results of the business of Bitfarms include but are not limited to: successful delivery of the new miners on the agreed schedule in accordance with the contract terms and the potential for further improvements to profitability and efficiency across mining operations; the construction and operation of blockchain infrastructure may not occur as currently planned, or at all; expansion may not materialize as currently anticipated, or at all; the digital currency market; the ability to successfully mine digital currency; revenue may not increase as currently anticipated, or at all; it may not be possible to profitably liquidate the current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on operations; an increase in network difficulty may have a significant negative impact on operations; the volatility of digital currency prices; the anticipated growth and sustainability of hydroelectricity for the purposes of cryptocurrency mining in the Province of Québec, the ability to complete current and future financings, any regulations or laws that will prevent Bitfarms from operating its business; historical prices of digital currencies and the ability to mine digital currencies that will be consistent with historical prices; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of digital currencies, capital market conditions, restriction on labour and international travel and supply chains; and there will be no regulation or law that will prevent Bitfarms from operating its business. The Company has also assumed that no significant events occur outside of the Bitfarms’ normal course of business. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company undertakes no obligation to revise or update any forward-looking information other than as required by law.

Contacts

For corporate inquiries:

Geoff Morphy

gmorphy@bitfarms.com

For media inquiries:

Ellis Ballard

ellis@yapglobal.com

Jules Abraham

Director of Public Relations

CORE IR

917-885-7378

julesa@coreir.com

Investor Relations Contact:

CORE IR

Tristan Traywick

Managing Director

516 22 2560

tt@coreir.com