Visit us at https://is.gd/iLCzx8

Visit us at https://is.gd/iLCzx8

Visit us at https://is.gd/DczP7F

The term Caspian comes from the world’s largest lake “Caspian Sea”. Just like the Caspian Sea, Caspian AMM allows users to bridge liquidity on L2, while also keeping L1 liquidity from becoming fragmented.

Written by: Donnager

Many Ethereum Layer 2 networks will be officially launched in the second half of the year, and multiple L2 networks will fragment the liquidity that was originally aggregated, which is a problem that will be faced sooner or later.

Especially for automatic market makers (AMM), there is a relatively obvious fund accumulation effect, and a larger amount of funds can provide a better trading experience. Even DEX such as DODO, Bancor, and Uniswap V3 are already trying new AMM solutions to improve capital utilization, but the problem of liquidity fragmentation will still exist.

StarkWare, a zero-knowledge proof technology research organization, proposed Caspian, an AMM program driven by Layer 2 networks, to try to solve the problem of liquidity fragmentation and improve capital efficiency. When StarkEx 3.0 goes live in June, Caspian as a conceptual solution has the possibility of landing.

The source of the term Caspian is the “Caspian Sea”, which is the largest lake in the world. The StarkWare team said, “Just like the Caspian Sea, Caspian AMM allows users to bridge liquidity on L2, while also keeping L1 liquidity from becoming fragmented.化。”

So in simple terms, what Caspian wants to achieve is to maintain liquidity in the L1 network, but to implement transactions by L2, which is even a bit like the “in-situ expansion” solution proposed by Celer’s Layer2.Finance.

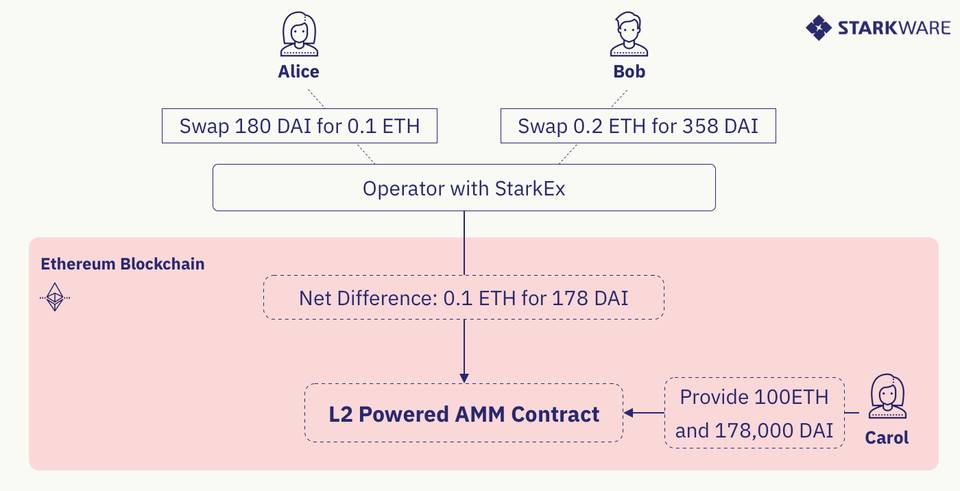

The essence of Caspian is equivalent to first internally matching L2 transactions, and handing over the remaining unmatched parts to L1’s AMM for processing.

Therefore, Caspian needs an off-chain operator (Operator), which will process transactions in L2 in batches, and each batch needs to process multiple transactions. It needs to imitate the logic of a smart contract. When a batch of transactions starts to end, it needs to provide quotes based on these status changes.

When a certain batch of transactions ends, the operator executes the AMM contract on L2 with a net balance to settle this batch of transactions. Among them, the core technology of StarkWare is involved in the settlement of each batch of transactions, a STARK zero-knowledge certificate needs to be submitted.

For example, Alice and Bob both submit their own transaction requirements in the Caspian solution, and the operator will first aggregate the two transactions, and then interact the net difference with the L2-driven AMM smart contract.

As the only entity interacting with L1, the operator has a lot of power, and it can even filter out the needs of some transactions and conduct transaction review.

So StarkWare stated that in order to eliminate the centralization risk of operators, the role of Operator can be decentralized, but the specific mechanism has not been made public, and perhaps the team has not yet explored these overly detailed parts.

However, there is still a problem, that is, how does the Operator sort the transactions fairly. For these transaction-related needs, the transaction sequence is also a part that may be attacked or exploited. Therefore, it may also adopt a auction mechanism similar to L1 or other more. Fair mechanism.

To be able to implement Caspian in engineering, the StarkWare team assessed that it would be possible at least after StarkEx 3.0 went live in June.

Because Caspian needs to be based on two brand new components included in StarkEx 3.0: L1 Limit Orders and Batch-Long Flash Loans. The L1 limit order function has been described in detail in the article DeFi Pooling by StarkWare .

The batch lightning loan function is a lightning loan that is not limited to a single transaction. It can last for a period of time and provides operators with the ability to mint tokens in L2, as long as these tokens are destroyed before the end of the batch— —This is similar to ordinary lightning loans. The purpose of establishing this mechanism is to improve the efficiency of operators. It can combine multiple limit orders into a single limit order.

As a conceptual solution, Caspian still has many missing details, such as how the Operator is decentralized (consensus), how transactions are sorted, which L2 and AMM protocols are aggregated, and the missing technical components (StarkEx 3.0), but this is a It is worth continuing to pay attention to the direction, because the problem of liquidity fragmentation may be a major challenge that multiple L2 networks will face after they go online.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the author’s personal views, and have nothing to do with the position of ChainNews. The information, opinions, etc. in the article are for reference only, and are not intended as or regarded as actual investment advice.

Chainlink has realized data aggregation at the data source, node operator, and oracle network level, providing more reliable price data for DeFi applications.

Original title: “One article to understand the three data aggregation layers of Chainlink price feed”

Written by: Chianlink

Smart contracts determine the way the on-chain protocol processes user funds, and the oracle connects to off-chain data sources to provide authoritative facts for the on-chain smart contracts, and ultimately trigger the transfer of funds. Off-chain events and on-chain contract logic together form a complete contract process. Therefore, to smoothly execute smart contracts, the oracle is as important as the underlying code.

The DeFi protocol usually needs to connect to market data to trigger on-chain events, the most important of which is asset price data, in addition to various types of data such as the market value of cryptocurrencies, exchange rates, and asset mortgage token reserves. These feed prices will be transmitted to smart contracts to trigger key on-chain activities, such as liquidating mortgage loans, providing fair market exchange rates for synthetic asset trading pairs, or using automated trading strategies to rebalance asset portfolios.

Chainlink price feed is currently the most mainstream price oracle solution in the DeFi market, guaranteeing billions of dollars in value for various mainstream and emerging agreements such as Aave, Synthetix, and Year. Chainlink price feed is pre-compiled to provide the most secure and reliable price oracle service for DeFi applications, and to ensure data quality to the greatest extent. Chainlink has achieved decentralization at the oracle node level and data source level. It strictly screens secure node operators and high-quality paid data sources to ensure that the performance and reliability of the oracle can be verified on the chain, and it has also established Encrypted economic incentive mechanism guarantees safety.

In this article, we elaborated on the three types of data aggregation involved in the price feed update, namely at the data source level, node operator level, and oracle network level, and discussed the data quality and oracle security of Chainlink price feed. . Each Chainlink price includes multiple data aggregation layers. Once you understand these three aggregation layers in depth, it is not difficult to understand why Chainlink can successfully guarantee the security of such a large-scale DeFi fund.

The basic flow chart of encrypted currency price data transmission to the on-chain DeFi application

The basic flow chart of encrypted currency price data transmission to the on-chain DeFi application

The first component of Chainlink price feed is the off-chain data source. The Chainlink oracle connects to the data source and obtains price data. The original price data usually comes from off-chain centralized trading platforms such as Coinbase and Binance, and on-chain decentralized trading platforms such as Uniswap and Kyber. Data aggregators such as BraveNewCoin and CoinGecko collect raw price data from these trading platforms and further process them into data sets, such as weighted calculations based on transaction volume, liquidity, and time difference, and eliminate outliers, filter out false transaction volumes, and monitor trading platforms “Downtime” event. To ensure reliable price data sources, it is necessary to fully cover each market, so that price points can reflect the comprehensive situation of all trading environments, rather than one-sidedly reflect the price of a trading platform or a small part of the trading platform. In this way, it can effectively prevent the price from being manipulated or the price deviation caused by the transfer of transaction volume to other platforms.

In order to fully guarantee the tamper-proof modification and reliability of data, Chainlink only obtains data from high-quality paid data aggregators. In other words, each data source used by Chainlink feeds fully covers all centralized and decentralized trading platforms, and adjusts based on transaction volume and finally aggregates price data, so it can effectively resist lightning loans or abnormal price deviations And other types of attacks.

In addition to the data source, the Chainlink price feed also includes multiple oracle node operators, each of which will send an on-chain response. These node operators are all run by professional DevOps teams that have extensive experience in running key blockchain infrastructure and guarantee billions of dollars in value on the chain. They are responsible for running Chainlink core software, obtaining off-chain market data, and transmitting it to the blockchain.

Node operators in Chainlink price feed will obtain price data from multiple independent data aggregators, take the median of the data, eliminate outliers, and ensure API interface connectivity. Therefore, not only does each data source fully cover all trading environments to aggregate price data, but each node aggregates data from multiple data sources and transmits it to the chain, which can better avoid single points of failure.

Chainlink node operators obtain data from multiple data aggregators and take the median

Chainlink node operators obtain data from multiple data aggregators and take the median

The third component of Chainlink’s price feed is the entire oracle network. The oracle network determines how a group of nodes work together to generate a reference data point on the chain. This usually requires aggregating the response data of all nodes. The most common aggregation method is to take the median of the data when the number of response nodes reaches a preset value. In addition, there are many different aggregation methods, and you can choose to aggregate on-chain or off-chain, depending on the throughput and cost of the underlying blockchain network.

Chainlink has aggregated the response data of many nodes, and these nodes have undergone security assessments. The aggregation method is to take the median when the number of response nodes reaches the preset value to trigger the price update on the chain (for example, in the example below, at least 14 nodes out of 21 nodes respond). This aggregation mechanism guarantees the overall running time of the oracle network, and effectively prevents data from being manipulated during transmission to the blockchain, and can even prevent extreme situations such as several nodes or data sources going offline or launching malicious attacks.

Chainlink ETH/USD price feed oracle network

Chainlink ETH/USD price feed oracle network

Chainlink price feed has realized data aggregation at the data source, node operator and oracle network level, so it can provide the most secure and reliable price data for DeFi applications and help it manage user funds. Because of this, Chainlink price feed has become the most mainstream and safest on-chain price data source in the DeFi economy, guaranteeing billions of dollars in value on the chain.

The concept of safety and reliability has penetrated into all levels of the Chainlink network. Applications that are connected to Chainlink can safely execute smart contracts and expand steadily to ensure greater value for users.

Source link: blog.chain.link

Disclaimer: As a blockchain information platform, the articles published on this site only represent the author’s personal views and have nothing to do with ChainNews’ position. The information, opinions, etc. in the article are for reference only, and are not intended as or regarded as actual investment advice.

The FinNexus solution is to maximize option liquidity through a single pool of multiple assets.

Written by: LeftOfCenter

With the gradual maturity of the crypto market, the crypto derivatives track also ushered in vitality. As one of the links, options have become the new favorite of the crypto derivatives track in 2020. From Binance, CME to OKEx, major trading platforms have joined options. Race track.

At present, Deribit still has an absolute advantage on the centralized trading platform options track. Data shows that as of the time of publication, Deribit has nearly $3.7 billion in open positions, accounting for 81.3% of the crypto options market. This achievement is of course related to its first-mover advantage. On the other hand, it is also due to its more tolerant option mechanism design. Not only did it first introduce a bilateral order model, but it also supports portfolio margin and supports a small amount of BTC as margin, which can be the largest Degree of aggregation of liquidity.

For options trading platforms, liquidity is the scarcest resource. It exists just like infrastructure. Liquidity is a prerequisite for guaranteeing a rich variety of options. Only with sufficient liquidity can it be possible to attract option purchases. Home.

In addition to the centralized options market, the decentralized options track is also a blue ocean. Whether it is the recent hot Hegic, or the steady and steady Opyn, and the DeFi options platform FinNexus, which solves liquidity problems through unique designs, none of it indicates As encrypted derivatives gradually mature, more powerful products will be ushered in.

Why does the financial industry need options? In other words, what is the effect of options on financial markets?

Option trading is a product of the development of the futures market to a certain stage. Option trading is conducive to improving the efficiency of the futures market, reducing the cost of futures participants to avoid risks, providing risk protection for hedgers and futures asset management businesses, and improving entity enterprises and institutions Investors use the enthusiasm of derivatives.

In the financial market, options are a hedging and speculation tool most commonly used by traders. Call and put options can predict the price trend of the market in the short and medium term. The greater the difference between the strike price and the current market, the smaller the premium, which means higher leverage. Investors can buy call options and put options at the same time to hedge risks. That is to say, regardless of whether the underlying asset is rising or falling, traders can exercise one of them to obtain income.

For investors, a number of different option strategies can be used flexibly to hedge the risk exposure of futures and spot positions. If the market is moving in the opposite direction, then traders can buy call/put options to minimize losses or protect unrealized profits.

As an emerging financial industry, crypto finance certainly needs options.

Compared with traditional finance, the cryptocurrency market is more volatile, which means that digital currency derivatives are more speculative and risky, and options, as a financial risk hedging tool, are indispensable in the crypto financial ecosystem tool.

We further need to ask, must the option products of encrypted finance be decentralized?

The answer is of course yes. It can be said that in the long run, whether it is trading, futures or options, the transition from centralization to decentralization of encrypted finance is an inevitable trend of historical development.

Why do you say that?

The core reason is that, compared to centralized platforms, decentralized products have the advantages of higher security and transparency, permissionless and non-custodial, and this is a natural advantage of decentralization. This advantage, supported by the recent liquidity mining and DeFi boom, makes Uniswap’s AMM mechanism spot trading model almost replace centralized exchanges.

According to Debank data, Uniswap currently has an average daily trading volume of more than US$285 million. In August this year, Uniswap once achieved a 24-hour transaction volume that surpassed the leading exchange Coinbase. It even achieved some mainstream trading depth in terms of depth. Transcendence of centralized exchanges. According to Coingecko data, in September of this year, the ETH/USDT trading pair on Uniswap fluctuated 2% at a depth of USD 5,512,912. In contrast, at the same time, the Binance Exchange ETH/USDT trading pair fluctuated at a depth of 1,708,071 at a 2% price fluctuation. U.S. dollars, which means that the slippage of ETH transactions on decentralized exchanges is better than that of centralized exchanges.

Compared with spot transactions, futures and options transactions often need to be decentralized, because the latter involves leveraged delivery, so compared to the former, the amount of funds and risks involved are often magnified several times. Once a centralized fraud event occurs , Resulting in greater losses.

Judging from the current situation of the crypto financial options market, the crypto financial options market is still the dominant one. The centralized option product Deribit occupies most of the market share, accounting for about 81.3% of the total market. Opyn and Hegic occupy a sporadic position in the field of decentralized options.

Lianwen asked Yang Tao, the founder of FinNexus, that since the transition from centralized to decentralized options is an inevitable trend, why do centralized options now occupy most of the market share?

Yang Tao said that since most decentralized options platforms currently provide liquidity based on the Uniswap platform, while centralized options platforms use the traditional order book model, in the short term, the so-called decentralization and centralization of the options market The difference is essentially the difference between the order book model and the AMM model, which means that under the current technical level, centralized options still occupy a portion of the market share.

In other words, the order book model and the AMM model will each target different user groups in a certain period of time. The order book model is for professional traders, while the AMM mechanism is more suitable for retail investors.

If you are a retail options trader who only occasionally conduct options trading operations, then the AMM mechanism of Uniswap can already meet this function well, so there is no need to go to a centralized option exchange for operations, but for a For professional option traders, a series of complex operations such as large batches of placing/withdrawing orders and making strategies are required. They can only use the order book mechanism. Under the current technical level, the performance of the decentralized order thinning model is low. The experience is difficult to compare to centralized exchanges, so most professional transactions tend to use centralized options exchanges.

Yang Tao said that once the Layer 2 expansion technology is upgraded, or the decentralized exchange can also integrate the order book model, then the centralized exchange will naturally be replaced by decentralization.

In the long run, with the rise of the second-tier expansion plan and the improvement of the order-thin model of decentralization, decentralization will definitely replace centralized options, and this replacement is natural.

In the past six months, the field of encrypted digital currency has witnessed a phenomenal outbreak of DeFi. DeFi solutions cover almost all track services in traditional finance, from spot, mortgage, loan and other derivatives. According to Debank data, the current total DeFi The locked position is approximately USD 16.7 billion.

However, decentralized options trading is still in its infancy. In the traditional financial field, options trading is a market with a scale of trillions of dollars, which plays a vital role in the world economy, and the crypto options track in the crypto market has just gained momentum.

Yang Tao said that according to the development law of the traditional financial market, the transaction volume of derivatives will be much larger than spot transactions, generally 9-10 times the scale of spot transactions, and the current crypto options market is far from reaching this level. This means that there is still much room for imagination in the future of the derivatives market. More importantly, as a component of DeFi Lego, decentralized options are easier to call by other protocols, resulting in richer decentralized products. This is something that a centralized protocol cannot do.

According to CryptoCompare, the trading volume of derivatives hit a record high in May 2020, and trading activities around cryptocurrency options have increased significantly.

“The digital currency derivatives track will usher in an explosion, of course, including the options track. A clear trend can be seen from the sharp increase in the trading volume of the centralized options exchange Deribit. Once an explosion occurs, it will be a very big one. Market. It can be said that decentralized options unicorns will inevitably appear in the market in the future, just like Uniswap, and may even be a decentralized platform with a larger scale than Uniswap and Compound.”

As the demand for cryptocurrency options buyers continues to grow, the market structure continues to mature. After the total open position of Bitcoin options reached US$5.16 billion on December 3, it has now fallen slightly to US$4.55 billion, but the growth momentum shows no signs of slowing down.

However, liquidity has always been the most scarce resource in the options market, which is determined by the product logic of the option itself.

Unlike spot or futures, the liquidity of options is more difficult to obtain. For spot, there is only one category, and for futures, there are at most several categories. For options, because there are different expiration dates, exercise prices, and bullish and bearish options, many different categories can be arranged and combined. Generally speaking, the farther the option is from the expiration date, the worse the liquidity will be, which is reflected in the larger bid-ask spread. In addition, due to the high volatility of BTC or ETH, it is difficult to accurately price options, which is why the spread of options is often high. These factors make it difficult to obtain the liquidity of options.

For options platforms, liquidity is as important as infrastructure, because only with sufficient liquidity can it be possible to attract option buyers.

Many mainstream exchanges are also targeting this market, but at present it is not easy to attract liquidity, and only Deribit remains the leader.

BitMEX launched option contract products in 2018. Although BitMEX has done a good job in futures contracts and is by far the most liquid exchange, it has never been able to develop liquidity in options contracts. The main reason is that BitMEX only allows investors to purchase options, but cannot independently issue options. In other words, there is only one option market maker on the platform, and the option market maker is the BitMEX platform itself, which means that the counterparty of the option buyer is the BitMEX platform that controls the spread.

Binance Exchange also launched the options platform, and likewise, only Binance Capital can create options. In other words, on the Binance Options platform, traders can only be buyers, not sellers. Binance is the only option. Issuer. This has resulted in the option premium on this platform being twice or even higher than similar products on other platforms that allow option trading. Since Binance is the only market maker in this market, this makes it impossible to form a competitive price through a true bilateral market. More importantly, Binance only provided a mobile terminal at the time, without an API, and only options with a maximum expiration time of less than one day.

Deribit is currently the largest options platform to date. Currently, it has nearly $3.7 billion in open positions, accounting for 81.3% of the crypto options market. Deribit is the first real options trading platform, and the liquidity of options is extremely sticky. The reason is that it launched the first bilateral order model, which means that anyone can sell options, and supports portfolio margin, which can achieve lower margin requirements, so capital efficiency is higher.

Currently, CME’s open interest in Bitcoin options amounts to US$230 million. Compared with other options platforms, CME Group’s option margin must be delivered in U.S. dollars, and the amount is high. In contrast, Deribit is more forgiving and allows a small amount of BTC as margin, which can attract liquidity to the greatest extent.

At present, the closest competitor to Deribit is the options platform launched by OKEx, which also supports the buying and selling of options. However, OKEx options do not support Portfolio Margin Account for the time being. Portfolio Margin Account can provide floating leverage to buy futures with real-time leverage. Floating and calculated based on position risk. Skew data shows that the total amount of open positions is currently 227 million US dollars, slightly lower than CME Group. The FTX option service supports electronic quotation requests (RFQ), allowing anyone to request and respond to quotations. According to Skew data, FTX currently has approximately $26.26 million in open positions in Bitcoin.

Compared with centralized options platforms, the volume and scale of decentralized options exchanges are far smaller than the former. The key reason is that it is currently in the early stage of encryption and there are few options trading participants leading to lack of liquidity. In traditional finance, liquidity is solved by professional option market makers. Generally speaking, the exchange will provide these market makers with some special risk hedging tools to balance risks.

Among the few decentralized options products, only two products are actually launched, namely Opyn and Hegic, and these two products also have problems such as lack of liquidity, low capital utilization, and scarcity of options. In addition, in the field of decentralized encrypted options in the early stage, there is no professional option market maker, and there is a lack of professional hedging tools. Even if someone is willing to participate in market making, there will be a great risk of loss.

Taking Opyn as an example, its model is essentially to tokenize traditional options, which is equivalent to moving options onto the chain. Opyn uses a physical delivery and full margin model. If you want to sell an ETH call option, It is necessary to add one ETH to the contract in full. When the buyer’s strike price is delivered, the ETH in the contract will be directly sent to the buyer instead of calculating the difference, which means that the utilization rate of funds is very low.

On the other hand, Opyn uses the AMM mechanism to provide liquidity, and the platform itself makes the market through Uniswap. This mechanism causes relatively high liquidity pressure, and ultimately only provides a limited number of options. Therefore, option products The categories are not rich enough.

In addition, the free loss of option market makers is very large. Unlike ordinary financial products, options have an “expiry date”. As the expiry date gets closer, the value of the option will decay. This is called the time value of the option, or the external value of the option. This kind of asset whose price has been declining (the final decline is close to 0 value) is placed in the AMM pool, and it is easy to incur gratuitous losses. For traders who provide liquidity, as the expiry date approaches, the risk is very high. Big.

Hegic is the star of the recent decentralized options track. The beta version was only released for 22 days, and the total lock-up amount (TVL) on the chain exceeded 20 million US dollars. This is a very remarkable achievement.

However, Hegic still has some problems, mainly due to the lack of option categories. Currently, only ETH and BTC call and put options are supported. The reason is that if you want to launch an option category, you need to provide matching liquidity depth. Bring a lot of liquidity capital needs.

This is exactly the market that FinNexus is aiming at and the problem that it is trying to solve. That is, by lowering the threshold of option market making, ordinary novice users can easily participate in option liquidity market making without complicated hedging strategies, which not only minimizes the risk, but also It can be used as a stable source of income. Backtesting data shows that this is a relatively low-risk and profitable financial management method.

Compared with other options products, FinNexus has created a unique MASP model, called Multi Assets Single Pool, which means that a variety of different options assets are gathered into a unified liquidity pool and provided by a unified stable currency Margin and liquidity support to maximize liquidity.

FinNexus currently provides options for multiple mainstream currencies such as Bitcoin, Ethereum, SNX, and LINK. For ordinary users, they only need to hold the stable currency USDC and invest in the liquidity pool to participate in market making. One fund pool is more than An encrypted option product provides liquidity and can also maximize the risk of the seller.

The most direct benefit of doing so is that FinNexus provides as many options categories as possible, which can attract more buyers. This not only means that the underlying asset fees are more abundant, in addition to mainstream cryptocurrencies such as Bitcoin and Ethereum, there are also many emerging potential stars such as SNX and LINK. Of course, physical assets such as oil and gold will even be added in the future. Reduce the risk relevance of the assets in the pool, and the option categories for the same underlying asset are also more abundant, that is to say, different expiration dates, strike prices, and call and put options categories can be borne by the unified pool. As the categories in this pool become more abundant and more funds are invested, it will also bring about a passive diversification of the counterparty’s risk.

Compared with the decentralized options platform Opyn’s full-margin physical delivery mechanism, FinNexus adopts a price difference settlement mechanism, while using cash delivery. The spread settlement mechanism means that the utilization rate of funds can be improved. In addition, FinNexus uses USDC stablecoin as margin settlement. Compared with BTC or ETH for margin settlement, USDC is suitable for various basic asset options, while BTC settlement is more suitable for BTC. Options. Therefore, USDC stable settlement options are more scalable.

Undoubtedly, the crypto options track is about to explode, and the focus of the options market competition is essentially the grabbing of liquidity. Only by attracting enough liquid market makers can it be possible to provide a wealth of options and more competitive options. Option prices naturally attract more buyers. At the same time, liquidity has a network effect, and liquidity properties generate more liquidity. It can be said that in the field of decentralized options, those with liquidity have the world.

At present, the centralized options platform Deribit is far ahead. In the long run, the transition from centralization to decentralization of options is an inevitable trend of historical development. We cannot be sure who will win in the future, but what is certain is the future winner It must be an insight into the spirit of open finance and incentive strategies that can attract ordinary people to participate in the core contribution of DeFi. For option products, this core contribution is to provide liquidity.

In a blog post on Friday, 0x Labs product manager Theo Gonella laid out the protocol’s ambitious plans to direct development towards a promising, if technically tricky horizon for permissionless exchange: seamlessly connecting the growing constellation of viable layer-1 blockchain platforms.

The Ethereum-based protocol, designed to be an interoperability toolkit for decentralized exchanges of all stripes, has seen marked success this year in connecting a network 30+ projects building with their API.

Throughout 2020, as Decentralized Finance (DeFi) boomed, so too did 0x’s usage: the protocol facilitated nearly $4 billion in trades across dexes and aggregators like Tokenlon and 1inch, and generated nearly $400,000 in protocol fees, according to the 0xTracker.

Likewise, 0x’s native token, $ZRX, saw a rally of 280% from $.259 to $.73, before a 50% drop amid the wider DeFi market rout.

As it looks to the future, however, 0x now plans to bring its vision of interoperability cross-chain.

“While Ethereum is the platform on which most tokenized value has emerged in the past years, we believe we are heading towards a multi-blockchain world with a vast web of interconnected networks forming the backbone of web3,” wrote Gonella. “Given our vision for 0x protocol as an open technical standard for p2p exchange, it is natural that the standard expand into new ecosystems as they emerge.”

The post laid out the signs of growth Ethereum competitor chains would have to exhibit in order for 0x to devote developmental resources, including unique digital assets, robust developer communities, and a deep pool of end users.

Gonella also acknowledged that cross-chain functionality and composability is a notoriously difficult problem, however.

Issues include porting wrapped assets of different standards across chains, opportunity cost for users who lock their tokens into cross-chain bridges, and necessary updates to the 0x infrastructure and tokeneconomic model, including staking and governance.

Despite the complexity of the task, Gonella struck an optimistic tone:

“We’re seeing a Cambrian explosion of innovation and creativity, and it’s only just getting started.”

Image Credit: Refer to Source

Author: Refer to Source Cointelegraph By Andrew Thurman