The term Caspian comes from the world’s largest lake “Caspian Sea”. Just like the Caspian Sea, Caspian AMM allows users to bridge liquidity on L2, while also keeping L1 liquidity from becoming fragmented.

Written by: Donnager

Many Ethereum Layer 2 networks will be officially launched in the second half of the year, and multiple L2 networks will fragment the liquidity that was originally aggregated, which is a problem that will be faced sooner or later.

Especially for automatic market makers (AMM), there is a relatively obvious fund accumulation effect, and a larger amount of funds can provide a better trading experience. Even DEX such as DODO, Bancor, and Uniswap V3 are already trying new AMM solutions to improve capital utilization, but the problem of liquidity fragmentation will still exist.

StarkWare, a zero-knowledge proof technology research organization, proposed Caspian, an AMM program driven by Layer 2 networks, to try to solve the problem of liquidity fragmentation and improve capital efficiency. When StarkEx 3.0 goes live in June, Caspian as a conceptual solution has the possibility of landing.

The source of the term Caspian is the “Caspian Sea”, which is the largest lake in the world. The StarkWare team said, “Just like the Caspian Sea, Caspian AMM allows users to bridge liquidity on L2, while also keeping L1 liquidity from becoming fragmented.化。”

So in simple terms, what Caspian wants to achieve is to maintain liquidity in the L1 network, but to implement transactions by L2, which is even a bit like the “in-situ expansion” solution proposed by Celer’s Layer2.Finance.

Principle: internal matchmaking + batch transaction

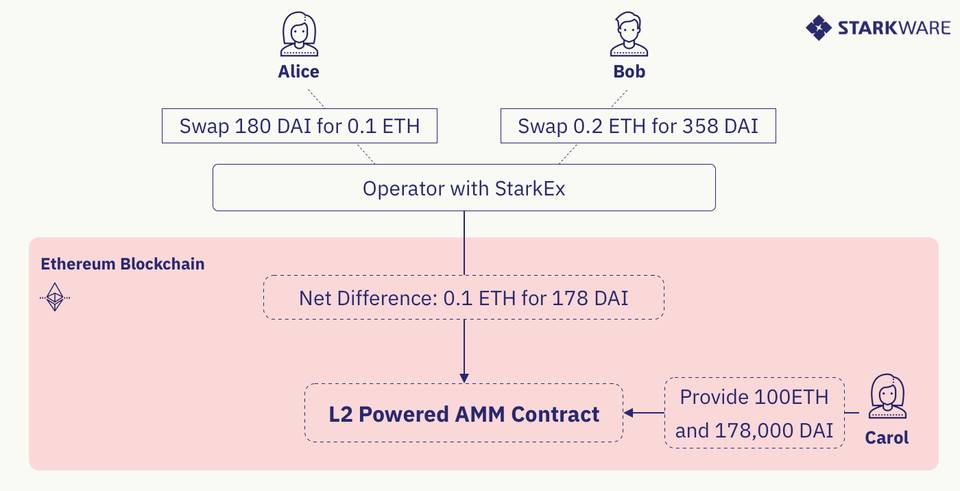

The essence of Caspian is equivalent to first internally matching L2 transactions, and handing over the remaining unmatched parts to L1’s AMM for processing.

Therefore, Caspian needs an off-chain operator (Operator), which will process transactions in L2 in batches, and each batch needs to process multiple transactions. It needs to imitate the logic of a smart contract. When a batch of transactions starts to end, it needs to provide quotes based on these status changes.

When a certain batch of transactions ends, the operator executes the AMM contract on L2 with a net balance to settle this batch of transactions. Among them, the core technology of StarkWare is involved in the settlement of each batch of transactions, a STARK zero-knowledge certificate needs to be submitted.

For example, Alice and Bob both submit their own transaction requirements in the Caspian solution, and the operator will first aggregate the two transactions, and then interact the net difference with the L2-driven AMM smart contract.

Does the operator have a centralization risk?

As the only entity interacting with L1, the operator has a lot of power, and it can even filter out the needs of some transactions and conduct transaction review.

So StarkWare stated that in order to eliminate the centralization risk of operators, the role of Operator can be decentralized, but the specific mechanism has not been made public, and perhaps the team has not yet explored these overly detailed parts.

However, there is still a problem, that is, how does the Operator sort the transactions fairly. For these transaction-related needs, the transaction sequence is also a part that may be attacked or exploited. Therefore, it may also adopt a auction mechanism similar to L1 or other more. Fair mechanism.

Prerequisite for Caspian: StarkEx 3.0

To be able to implement Caspian in engineering, the StarkWare team assessed that it would be possible at least after StarkEx 3.0 went live in June.

Because Caspian needs to be based on two brand new components included in StarkEx 3.0: L1 Limit Orders and Batch-Long Flash Loans. The L1 limit order function has been described in detail in the article DeFi Pooling by StarkWare .

The batch lightning loan function is a lightning loan that is not limited to a single transaction. It can last for a period of time and provides operators with the ability to mint tokens in L2, as long as these tokens are destroyed before the end of the batch— —This is similar to ordinary lightning loans. The purpose of establishing this mechanism is to improve the efficiency of operators. It can combine multiple limit orders into a single limit order.

As a conceptual solution, Caspian still has many missing details, such as how the Operator is decentralized (consensus), how transactions are sorted, which L2 and AMM protocols are aggregated, and the missing technical components (StarkEx 3.0), but this is a It is worth continuing to pay attention to the direction, because the problem of liquidity fragmentation may be a major challenge that multiple L2 networks will face after they go online.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the author’s personal views, and have nothing to do with the position of ChainNews. The information, opinions, etc. in the article are for reference only, and are not intended as or regarded as actual investment advice.