◆Cryptocurrency market conditions <neutral>

Bitcoin (BTC), the number one cryptocurrency market capitalization for the past 24 hours, continues to be bullish, exceeding the $57,000 mark during the intraday, and is undergoing a sale process, and can reach $60,000 beyond the previous high of $58,000. It is noted whether there will be. Some analysts have raised their short-term price outlook for Bitcoin (BTC) to $60,000, raising expectations for a full-fledged bull market turnaround.

According to the Institute’s on-chain transaction volume index analysis (refer to “Analysis of Bitcoin Transaction Volume on the Day” on page 11), the Bitcoin spot transaction volume on major exchanges, which had declined as the market price rose, turned to an increase since last Tuesday, leading to an upward trend. It is expected to be further strengthened.

Last night, on the back of sound US inflation and new stimulus measures, the US Dow index broke the record for the first time in history, breaking the 32,000 mark, but the Nasdaq index, which focuses on technology stocks, fell slightly. This is due to the sluggishness of big tech stocks such as Tesla (-0.82%), Apple (-0.91%), Amazon.com (-0.17%), NVIDIA (-0.42%), and Microsoft (-1.36%).

As of 14:00 on the 11th, the price of bitcoin based on CoinMarket Cap is $55,640.50, the 24-hour trading volume is about $52.8 billion, and the market cap is about $1.4 trillion. The total cryptocurrency market capitalization is USD 1.74 trillion, the Bitcoin market cap share is 61.0%, and the Ethereum market cap share is 12.2%. The total cryptocurrency market capitalization decreased by 0.08% compared to the previous day, and the market cap excluding bitcoin increased 0.23% compared to the previous day, making it stronger than altcoin compared to bitcoin, and the market cap of bitcoin decreased 0.26% compared to the previous day. The market share of Bitcoin decreased by 0.19% compared to the previous day, and it was analyzed that the decline rate of bitcoin was greater than the average decline rate of altcoins.

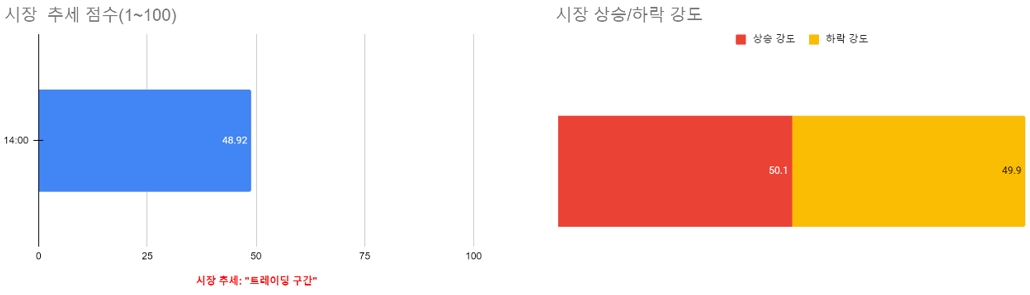

On the other hand, according to the Weiss Crypto Index, the market that had been going back and forth was stronger as buying and selling prices alternated after opening.As of 14 o’clock, in the market on the same day, the selling tax for bitcoins was stronger than altcoins. Was analyzed to be high.

As of 14:00, W50, a cryptocurrency market index including bitcoin, is +0.56%, W50X, a cryptocurrency market index excluding bitcoin, is +0.87%, WLC, an index centered on large stocks, is +0.50%, and an index centered on medium-sized stocks. WMC recorded +0.94% and WSC, an index centered on small stocks, recorded +0.41%.

As of 14:00 on the 11th, the ratio of buy:sell cumulative transaction volume for the past 24 hours was 46%:54%, which showed a high selling ratio, and as of 14:00, the long/short ratio of each exchange was also analyzed to be strong on average. . (Refer to Table 1)

At the same time, on the cryptocurrency derivatives exchange BitMEX, the basis of bitcoin futures was around +76.0, and the basis of Ethereum futures was around +4.45. The price of bitcoin futures on the Chicago Merchandise Exchange (CME) is falling. March futures traded at $56,385.0, down $235 (-0.42%) from the previous day.

◆Main Cryptocurrency Prices <Neutral>

As of 14:00 on the 11th, the domestic bitcoin (BTC) price rose 0.19% from the previous day to 64.47 million won, Ethereum (ETH) rose 0.39% to 2.88 million won, and Polkadot (DOT) fell 1.04% to 42,850 won. did. Ada (ADA) was 1,305 won as of the previous day, Ripple (XRP) fell 1.13% from the previous day to 527 won, Bitcoin Cash (BCH) rose 1.60% to 640,000 won, and Stellar Lumen (XLM) fell 0.21% to 469 won. , Chainlink (LINK) is trading at 33,950 won, down 1.57% from the previous day, and Litecoin (LTC) is trading at 228,000 won, down 0.91%.

At the same time, the global cryptocurrency market price based on coin market cap is rising, as of 24 hours ago, 5 of the top 10 stocks by market capitalization. The international Bitcoin (BTC) price is $55,640.50, up 3.30% from the same time the day before. Ethereum (ETH) rose 1.35% to $1,809.09, while Binance Coin (BNB) rose 3.15% to $283.63. Cardano (ADA) fell 2.15% from the previous day to $1.13, Polkadot (DOT) rose 1.00% to $37.00, Ripple (XRP) rose 1.63% to $0.4576, Uniswap (UNI) fell 3.03% to $30.60, Light Coin (LTC) rose 1.74% to $199.11, and Chainlink (LINK) fell 2.09% to $29.43.

◆ Analysis of major media and market experts <neutral>

In the market, the participation of large institutional investors, including the notable purchases of some companies such as Tesla, Square, and MicroStrategy, and easing monetary policies such as low interest rates and asset purchases by central banks around the world have eroded the value of fiat currencies such as the US dollar. On the other hand, the analysis that Bitcoin perceived as an inflation hedge (hedging) is acting as a major factor is dominant.

(Positive opinion)

① Cointelegraph, a media specializing in cryptocurrency, said, “The low-priced purchases of institutional investors using price adjustment had a significant impact on rebounding Bitcoin, which had plunged below 44,000 dollars, to 57,000 dollars in 10 days.” On the 21st, it plummeted 25% from the all-time high of $58,352 to $43,700 on the 28th. After that, Bitcoin continued to rise and exceeded $57,000 on the day of the day, and it was found that during this period, major institutions such as Square continued to buy bitcoin.” Reported.

② Cryptocurrency media newsBTC analyst Yashu Gola said, “Bitcoin confirmed the MACD (Moving Average Convergence and Diffusion Index) Bull Cross this week. MACD Bull Cross is the potential price increase of assets. It is interpreted as a signal of,” he said, and said that the market analysis portal trading shot predicts that the BTC/USD pair price will rise to $65,000.

③ Mathew McDermott, head of Global Digital Assets at Goldman Sachs, said the demand from institutional investors for bitcoin and cryptocurrency is growing rapidly. “According to the Goldman Sachs survey, about a third of institutional investors currently own cryptocurrency,” he said. In addition, more than 50% of institutional investors said they plan to increase the proportion of digital assets in their portfolio in the next few months.” He added, “Loose monetary policy is driving the surge in institutional demand for digital assets.”

④ Crypto Briefing, a media specializing in cryptocurrency, said, “If Bitcoin, which has converted the decisive level of resistance to the level of support, remains above 50,000 dollars for the time being, it will be able to rise to 61,000 dollars as the buying pressure increases around the current price level.” Expected.

⑤ Cryptocurrency analyst Josh Rager said, “The positive correlation between the US’s massive stimulus package and the US stock market could help the bitcoin recover further.” After the breakthrough, it is expected to retest the all-time high of over 58,000 dollars.”

⑥ Cryptocurrency analyst Michael Van De Pope predicted, “It is important for Bitcoin to turn the 52,000 dollar resistance line into a support line,” he said. “If this happens, BTC will rise rapidly to the 56,000 dollar level.” “It is necessary to adjust the bitcoin price before the upward trend resumes,” he explained. “The current momentum slowdown is very natural.”

⑦ Bloomberg Intelligence’s chief strategist Mike McGlon said recently that investors are rapidly shifting their investments from gold to bitcoin as the preference for bitcoin as a store of value among investors has increased. He pointed out that while precious metals, which have existed for thousands of years, continue to remain as collectibles, Bitcoin is a hedge against inflation.

⑧Cointelegraph, a media specialized in cryptocurrency, cited Glassnode data and said, “The amount of bitcoins stored in the centralized exchange (CEX) has decreased by about 20% in 12 months.” According to the media, this is that investors are moving funds from exchanges to cold storage for long-term holdings of bitcoins, which could have a positive impact on bitcoin prices.

⑨ Cryptocurrency trader Peter Brant pointed out, “Many experts point out that bitcoin has risen excessively, but BTC will continue to rise in the future.” He said, “The reason for the increase in BTC price is that the depreciation of the US dollar has just begun,” and predicted that the dollar purchasing power will continue to decline in the future.

(Neutral opinion)

① Aayush Jindal, an analyst at Cryptocurrency NewsBTC, said, “If the BTC/USD pair price remains above USD 49,500 and USD 50,500, we can start a new rise, and if we exceed the USD 52,000 resistance level, we will start at USD 54,500. It can continue to be strong,” he predicted.

(Negative opinion)

① Shane I, who is in charge of product research and cryptocurrency derivatives development at Bybit, said that historically, looking at the cycle of bitcoin, March was not a good time for bitcoin. He expected to show a cautious attitude while leaning.

② Coinnis special analyst’JIn’s Crypto’ said, “On the 10th, it fell around USD 56,000 without overcoming short-term downside pressure. Although it is showing a rebound, it is difficult to see a surge in terms of a rise that does not accompany the trading volume.” At the moment when price volatility has decreased and price volatility has increased, a short-term downtrend may occur.”

◆Comprehensive Analysis of Bitcoin Market Price <Strengthening>

Bitcoin daily market price (see Figure 6) continues to be strong day after day. On the same day, there was an intraday adjustment trend due to an intraday decline in the U.S. CME bitcoin futures market price and the aftermath of the option maturity price, but the atmosphere is not significantly pushed by the continued buying trend.

Therefore, even if there is a slight adjustment, support is expected near the moving average of the 5th. Despite the recent increase, bitcoin trading volume, which showed a decreasing trend, has turned to an increasing trend, and the rise to the previous high seems okay. However, it is still unclear whether it will be possible to break through the top of the Bollinger Band, which is technically at the $58,000 level. (Refer to’Analysis of Bitcoin Transaction Volume on the Day’ on page 11)

Today is the expiration date of daily options for Bitcoin and Ethereum on the DRBT exchange. As a result of the simulation based on 14 o’clock, the expected settlement price for the two stocks was estimated to be around US$56,000 and US$1,820, respectively, as of 14:00. The price was adjusted upwards from the price of the $55,000 range, which was predicted at 10 am, and this is believed to be due to the strong intraday buying trend. However, it is also possible to confirm the backlash, and it seems that the actors have not been able to abandon their regret over the bearish turnover rather than the aggressive upward position change while changing positions. (Refer to the’Analysis of the Share of Bitcoin Option Open Agreements on the Day’ on page 15)

Binance BTC/USDT, calculated by the institute’s quant program, has an important price change for the day of $55,415. Bitcoin’s current market price is between the market price of the day and this price, so it is safe to try when the market price recovers the market price of the day. However, even if the market price recovers, it is not the same as the recent uptrend, or if the market price is not strong and shows weakness, it may fall to the 5th moving average and rise, so it is necessary to clear the volume and watch. For more detailed analysis based on market data, see ‘7. Please refer to the’Quantitative Analysis’ section.

◆Technical Analysis <Strengthening>

As of 14 o’clock on the 11th, the technical analysis of the daily price movement of bitcoin on Upbit, a domestic cryptocurrency exchange, and Binance, a foreign exchange, all showed’active buy’. Looking at the detailed evaluation items, Upbit came out with 7’Buy’, 0’Sell’ and 0’Neutral’ opinions, and’Strong Buy’ opinions among the oscillator indicators, and the moving average indicator was 12’Buy’ and It was summarized as a’buy’ opinion with zero’sell’.

If you look at the detailed items of Binance, among the oscillator indicators,’Buy’ is 7,’Sell’ is 0, and’Neutral’ is 0, sending a’active buy’ signal, and the moving average indicator is’Buy’ is 12, ‘Sell’ was summarized as’Buy’ with zero.

◆Quantitative analysis

◇Crypto Fear & Greed Index <Strengthening>

The’Fear and Greed Index’ provided by the cryptocurrency data provider Alternative.me maintained the’Extreme Greed Level’ with 73 points, up 5 points from the previous day. This indicates that overheated investor sentiment continues. A value closer to 0 indicates extreme fear in the market, and a value closer to 100 indicates extreme optimism.

◇Comparison of return by asset compared to the beginning of the year (%) (as of 14:00 on March 11) <Strengthening>

Despite external macroeconomic instability, the price of bitcoin continued to rise. As of 14 o’clock on the 11th, the US CME Bitcoin futures’ return to the beginning of the year soared 14.18% compared to last Tuesday, holding 79.46%, maintaining the No. 1 ranking among valuation assets. Second place was oil futures with a 35.85% return, but fell 0.75% over the same period.

The demand for a $38 billion 10-year Treasury bond bid, held the afternoon of the previous day, received positive reviews from the market, easing concerns that US debt growth would put too much pressure on the Treasury market and boost Treasury yields. International oil prices rose in anticipation of a recovery in demand despite a large increase in US crude oil stocks.

The increase in crude oil stocks is attributed to the damage to refinery facilities following a record cold wave. Nevertheless, expectations for a rapid economic recovery are maintained, with the US House of Representatives passing a $1.9 trillion stimulus package. It is analyzed that the expectation that large-scale stimulus measures will revitalize the demand for crude oil has led to a rise in prices. Meanwhile, since last Tuesday, the dollar index and gold futures fell 0.55% and 2.25%, respectively, while the S&P 500 index rose 2.09%.

◇Comparison of yield by cryptocurrency compared to the beginning of the year (%) (as of 14:00 on March 11) <Strengthening>

Although the price of bitcoin has skyrocketed, the rate of growth for most cryptocurrencies is still limited. Among the top 5 stocks by market capitalization, the rate of increase was only similar to that of Bitcoin, except for the surge in Binance Coin (BNB) since last Tuesday, and Uniswap (UNI) and Chainlink (LINK) declined. As of 14:00 on the 11th, Binance Coin (BNB) ranked first with 638.78%, Cardano (ADA) second with 543.65%, Uniswap (UNI) third with 530.77%, and Polkadot (DOT) with 347.21% With 145.29% in fourth place and LINK in fifth place.

◇Bitcoin on-chain indicator analysis

① Analysis of Bitcoin transaction volume on the day <Strengthening>

Analyzing the trading volume of BTC/USD’s on-chain data on the same day makes it easy to check the direction of the bitcoin market and respond to it. Indicator 1 in Figure 13 shows the spot trading volume of BTCUSD, BTCUSD or BTCUSDC on 10 major exchanges (Binance, Bitfinex, PoloniX, Bitex, Coinbase, Bitstamp, Kraken, HitbittyC, Gemini), Indicator 2 shows the trading volume of BTCUSD or XBTUSD indefinite futures on 7 derivatives exchanges (Binance Futures, OKX Futures, OKX Futures, Huobi Futures, FTX Futures, Kraken Futures, Delibit, BitMEX) in real time. Sum up and display.

Looking at Index 1 in Figure 13, it can be seen that the bitcoin spot trading volume of major exchanges, which had been declining, is increasing in earnest. This translates to meaning that investors are beginning to be convinced about the uptrend. The increase in futures trading volume in Figure 13-2 means that volatility has increased during the ascent process. Unlike the smoothness in the previous uptrend, short-term trading opportunities also increase because selling forces aiming for short-term gains emerge. If you don’t, you should be careful as the loss may increase.

Looking at the indicators in Figure 14, the difference between the total number of purchases and the total number of sales is not clear, but the number of purchases is rather large. During the intraday, there may be changes depending on the market change, but price volatility is progressing to the highest point in the upward direction, so there is a high possibility that it will close on the day. Today is the expiration date of daily Bitcoin and Ethereum options on the DRBT exchange, and the expected settlement price for both stocks is estimated at $55,400 and $1,780, respectively, as of 14:00.

② Bitcoin price and Korea premium index trend analysis <strong>

Although the Kimchi premium index is still above ‘0’, the gap between Bitcoin and Ethereum has widened considerably as the price of bitcoin and Ethereum has risen, so we don’t think it will simply turn into a downtrend. Of course, you should be wary of short-term surges, but you should be wary of a sharp decline, but now that only bitcoin has erupted the market price, it is expected that good results will be obtained if you respond to the bottom of each stock in case of a decline.

③ Analysis of mass transaction volume according to on-chain indicators after bitcoin plunge <Strengthening>

Figure 17 shows the trend of the Bitcoin balance held by major exchanges. As the recent bitcoin plunged after the all-time high, the bitcoin balance, which has increased a lot, has declined significantly now when the market price surged. Therefore, an additional rise in the bitcoin market is expected.

◇Analysis of the share of non-settled bitcoin options on the day <weak>

As a result of analyzing the percentage of outstanding contracts aggregated from bitcoin options issued by major cryptocurrency exchanges (Deribit, OKEx, Bit.com) (see Figure 18), the rising position was 14 at 10 o’clock, which was 4.00% based on the number of contracts. At the time, it was changed to a 41.87% decline. In terms of premium, it is expected that intraday decline is expected as the intraday decline is expected as it will change from 19.80% (buy call option): 15.91% (buy put option) to 11.25% (sell call option): 3.34% (buy put option) at 10 o’clock. see.

In the same way, as a result of analyzing the percentage of pending contracts aggregated from bitcoin options issued by the DRBT exchange (see Figure 19), the downside position, which was 26.90% at 10 o’clock in terms of the number of contracts, was 35.71% at 14 o’clock. In terms of premium standards, it has been changed from -19.80% (sell call option):-5.38% (sell put option) to -18.46% (sell call option):9.82% (buy put option) at 10 o’clock. It can be seen that the composite position has also strengthened in the sell direction three hours ahead of the market.

contact@blockcast.cc