The cryptocurrency trading market is in a highly fragmented state, and it is difficult for traders to obtain global liquidity and price discovery.

Written by: Haohan, CEO of Apifiny

Compilation: Apifiny Asia Pacific Market

Currently, the cryptocurrency trading market is in its early stages, and in a decentralized market, regulation plays a key role.

“Fortune” magazine believes that Coinbase’s IPO plan is “a milestone in the crypto industry.” Like Netscape’s IPO plan, which marked the legitimacy of the Internet, Coinbase also sent a signal to the general public: In the eyes of the US Securities and Exchange Commission (SEC), cryptocurrency transactions are legal, compliant, and safe. Investors will have the opportunity to hold stocks on the largest crypto trading platform in the United States.

Many people view their investment in Coinbase as an investment in the future of the cryptocurrency trading industry. Coinbase is the largest cryptocurrency exchange in the United States by trading volume, and its trading volume is three times that of the second largest exchange in the United States, even leading the international level. However, the size of the cryptocurrency trading market is still far from that of the traditional trading market.

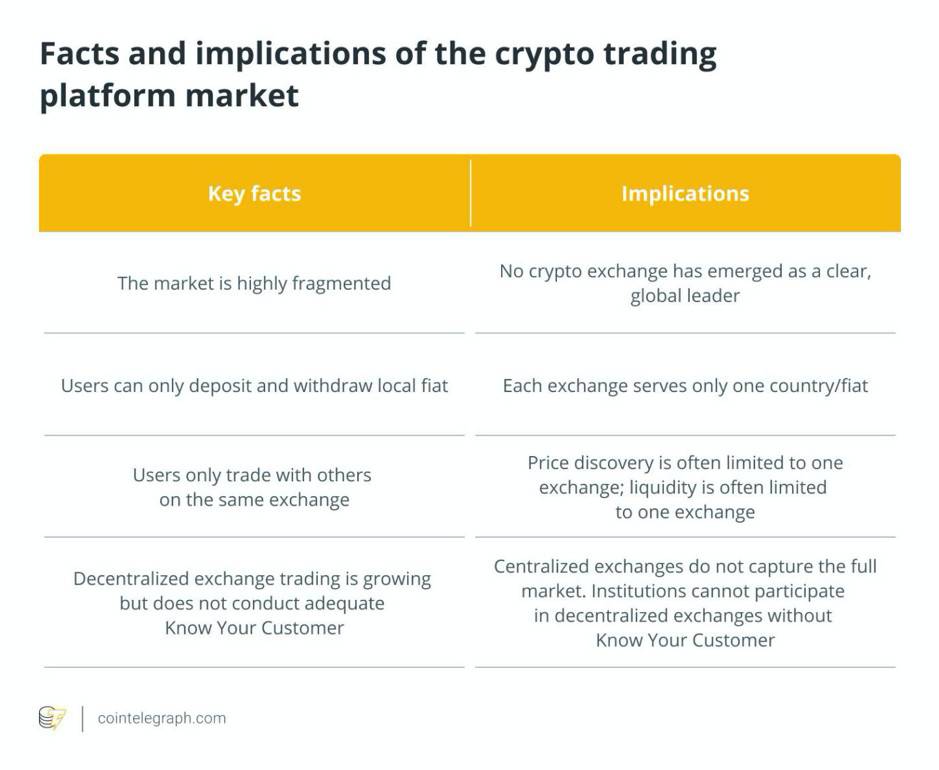

In order to better understand the nuances of the crypto trading platform market, we’d better observe the status quo of some industries first.

What is mentioned on the table are all important factors that affect the maturity of the market, and at the same time are the problems currently faced by cryptocurrency trading institutions. Currently, there is no single exchange that allows traders to obtain global liquidity, discover cross-border prices, and obtain the best prices in the world.

Today, the cryptocurrency trading market is still highly fragmented and there is no leader.

The trading volume of the world’s five largest cryptocurrency exchanges accounted for 41% of the global total. Among them, the trading volume of Coinbase, the largest exchange in the United States, accounts for only 2.1% of the global trading volume, ranking only 19th in the world. In the global market, there is no mature market leader that we expect.

According to the above data, the share of NYSE’s global stock trading volume is more than 12 times that of Coinbase’s global digital currency trading volume. The daily trading volume of the top two U.S. stock exchanges accounted for more than 50% of the global daily trading volume, while the trading volume of the top two U.S. crypto exchanges accounted for only 3% of the global trading volume.

Compared with traditional stocks, the cryptocurrency market is highly fragmented. The world’s two largest stock exchanges account for 51% of the global daily trading volume of stocks, while the world’s three largest cryptocurrency exchanges account for only 27% of the global daily trading volume of cryptocurrencies.

Lack of a unified global trading market

The cryptocurrency trading market is still in its infancy. In communicating with institutional traders and independent professional traders, we learned that institutions are still seeking platforms that meet institutional-level trading capabilities, and these requirements cannot be achieved on a single platform. E.g:

- Global price discovery-able to get the local currency standardized price in the global market.

- The world’s best transaction quotation-global order book, standardized processing according to exchange rate and local currency fees.

- Global liquidity acquisition-access to the liquidity of the global trading market, not just the liquidity of an exchange.

Each exchange is now its own trading “inland lake”, but there is no “canal” between them. In the US, traders can only trade with 2.1% of users worldwide, and their order books are completely different from other US trading markets (such as Coinbase and Kraken).

At present, only those users who can manage multiple exchange accounts in multiple countries and regions can achieve “global trading volume, liquidity and price discovery”, which is an arduous task that occupies both legal resources and technical resources.

Obviously, traders will benefit from a global order book based on a single currency, as well as the liquidity required to obtain the world’s best prices and execute large transactions. The industry urgently needs a “cryptocurrency version solution” equivalent to the National Best Trading Offer (NBBO) of traditional securities.

Centralized exchanges are only part of the trading landscape

Binance and Coinbase are centralized exchanges that match orders from buyers and sellers, and execute transactions and settlements. The user’s cryptocurrency assets are kept by the exchange, and the user can only trade with other users on the same exchange. Even in terms of total amount, centralized exchanges cannot capture the total trading volume of the entire digital asset.

All this is because of the rise of decentralized exchanges, which realize peer-to-peer transactions. Decentralized exchanges usually realize the direct exchange of assets between traders without knowing customer information. In 2020, Uniswap’s trading volume once surpassed Coinbase, and all decentralized exchanges may be on par with centralized exchanges. Therefore, if you do not understand decentralized exchanges, you will not be able to fully understand the situation of the encrypted trading market.

Finding out how to incorporate the price discovery and liquidity of decentralized exchanges into centralized exchanges will have important advantages.

Decentralized exchanges are developing, but lack infrastructure to help them expand

The trading volume of decentralized exchanges accounts for approximately 15% of the total cryptocurrency trading volume (based on CoinMarketCap data on February 16). The trading volume of decentralized exchanges has been growing rapidly. Uniswap’s trading volume has surpassed Coinbase even in 2020. Surprisingly, Uniswap achieved this feat with only 20 employees. Today, Venus’s trading volume is on par with Binance, and at the time of writing, Binance’s 24-hour trading volume is the market leader.

Professional traders may pay more attention to the security of “wallet-to-wallet” or “peer-to-peer” transactions in decentralized exchanges. But two problems still exist. First, without KYC on counterparties, institutional traders cannot trade on decentralized exchanges. Second, compared with centralized exchange transactions, the public chain technology supporting decentralized exchanges is slower and more expensive.

Institutional investors need decentralized exchanges that are faster, cheaper, and have sound KYC procedures. Therefore, decentralized exchanges must be built on faster and cheaper blockchains to attract institutional traders.

There is no real centralized exchange-only real brokers

What is even more confusing is that today’s crypto exchanges are more like regional brokers than real, global exchanges. Take the example of trading Apple (AAPL) on E-Trade and Bitcoin (BTC) on Coinbase.

In the United States, professional traders who want to trade BTC can only participate in a small part of the global trading market through Coinbase. Price discovery and liquidity are only obtained through the BTC/USD order book on Coinbase. In other words, more than 97% of the world’s supply, demand, price discovery and liquidity can only be obtained through hundreds of exchanges.

In summary, compared to selling AAPL on E-Trade and selling BTC on Coinbase:

- E-Trade placed an order on Nasdaq, almost 100% of AAPL spot transactions can be captured.

- Coinbase places orders in its own order book and can only get 2.1% of all transactions worldwide.

The status quo is that there is currently no real “global cryptocurrency trading market” in the world, but only hundreds of smaller local markets. If you compare the current status of the global cryptocurrency market to the traditional trading market, that is, AAPL is sold on more than 300 different exchanges, each with its own buyers and sellers.

There are two aspects to this problem. First, trading on a centralized exchange takes away many of the advantages of decentralized assets. Secondly, cryptocurrency transactions are fragmented into hundreds of scattered transaction “inland lakes”, each lake has its own local legal currency and cryptocurrency supply and demand relationship.

Centralized trading manages token listing permissions, custody, order matching and execution, and brokerage services. When users trade on a centralized exchange, users will give up a lot of control.

This centralized power brings hidden dangers to security and compliance, which has caused criticism from the market. In fact, traders in the Asia-Pacific region have initiated multiple refunds to show their resistance to CEX transactions. The younger generation is disgusted with centralization and dares to challenge it. The recent aerial warfare by American retail investors is a clear proof. And decentralization can ensure that no one entity can fully control the cryptocurrency.

Centralized exchanges are severely restricted in accessing the global market. Exchanges such as Coinbase and Gemini only accept users of fiat currency trading pairs (US dollars only) in a limited area (US only), while E-Trade opens access to many exchanges, stocks, and exchange-traded funds for its traders. Waiting for the door. In contrast, centralized exchanges closed the door to all other exchanges, severely restricting price discovery and liquidity, which resulted in higher spreads, lower fill rates, and higher slippage, namely Generally speaking, the market is inefficient. The concept of best buy and sell does not yet exist in the crypto world, because the BBO on Coinbase is not the same as the BBO on Gemini, Binance or Huobi.

The services provided for professional traders are not yet complete

From the perspective of professional traders, the current market does not yet have sufficient maturity and global trading capabilities. The segmentation of the cryptocurrency trading market is still in its infancy, and the needs of professional traders have not been met. The main reasons are as follows: (1) unable to enter the global market efficiently; (2) unable to obtain the best price in the global market, Nor can it obtain institutional-level liquidity.

In addition, due to the lack of KYC processes, it is not yet feasible for institutional traders to participate in decentralized exchange transactions. However, ordinary traders in Uniswap are very active. Uniswap’s users are completely on-chain transactions, open and transparent, and its 300,000 users have more transactions than Coinbase, which claims to have 35 million users. This shows that the entire giant whale market is traded outside of centralized exchanges, completely subverting the market’s understanding that Uniswap and decentralized exchange users are mainly retail investors.

No trading market can truly cover the world, retail and institutional traders cannot enter the truly global market, and there is no trading market that provides institutional-level DEX transactions.

Asset digitization will drive industry growth

The industry agrees that the continued digitalization of assets is inevitable. Bitcoin and Ethereum (ETH) are the native tokens of the blockchain. At present, the main transaction volume of the cryptocurrency trading market comes from these two mainstream currencies. However, the market value of cryptocurrencies is less than half of Apple’s.

Compared with the untapped digital asset market, the stock market is almost negligible. Although there is a great opportunity, it is still too early to predict the results.

Numerous exchanges expose traders to compliance risks

Some leading exchanges around the world allow a large number of controversial token transactions, and many exchanges have insufficient anti-money laundering regulations. Although some exchanges claim to have licenses in some countries, it is difficult to imagine using a single country’s exchange license to provide global users with legal compliance in derivatives transactions. These compliance risks have brought severe challenges to the stability of some exchanges. Not long ago, after BitMEX was prosecuted, users lost and transaction volume declined, and the market structure of derivatives changed rapidly.

Institutional level transaction technology innovation has not yet become widespread. The current trading volume ranking only illustrates the current situation. The future story will be told by the trading markets. These trading markets provide real and global best buying and selling price discovery, and institutions’ understanding of DEX pricing and liquidity Access, and the ability to execute global trading strategies on a single platform.

Source link: cointelegraph.com